10-K: Annual report [Section 13 and 15(d), not S-K Item 405]

Published on March 31, 2025

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

(Mark One)

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended

OR

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _________________ to _________________

Commission File Number:

(Exact name of Registrant as specified in its Charter)

|

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

|

|

|

(Address of principal executive offices) |

(Zip Code) |

Registrant’s telephone number, including area code: (

Securities registered pursuant to Section 12(b) of the Act:

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

|

|

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES ☐

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. YES ☐

Indicate by check mark whether the Registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the Registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer |

|

☐ |

|

Accelerated filer |

|

☐ |

|

☒ |

|

Smaller reporting company |

|

||

|

|

|

|

Emerging growth company |

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements.

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). YES

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the Registrant, based on the closing price of the shares of common stock on The New York Stock Exchange on June 28, 2024, was $

The number of shares of Registrant’s Common Stock outstanding as of March 28, 2025 was

DOCUMENTS INCORPORATED BY REFERENCE

Portions of Part III of this Form 10-K are incorporated by reference from the registrant’s definitive proxy statement for its 2025 annual meeting of shareholders, which will be filed with the Securities and Exchange Commission within 120 days after the end of the fiscal year covered by this Form 10-K. Except with respect to information specifically incorporated by reference in this Form 10-K, the proxy statement is not deemed to be filed as part of this Form 10-K.

Table of Contents

|

|

Page |

PART I |

|

|

Item 1. |

4 |

|

Item 1A. |

12 |

|

Item 1B. |

29 |

|

Item 1C. |

29 |

|

Item 2. |

30 |

|

Item 3. |

30 |

|

Item 4. |

30 |

|

|

|

|

PART II |

|

|

Item 5. |

31 |

|

Item 6. |

31 |

|

Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

32 |

Item 7A. |

41 |

|

Item 8. |

42 |

|

Item 9. |

Changes in and Disagreements With Accountants on Accounting and Financial Disclosure |

42 |

Item 9A. |

42 |

|

Item 9B. |

42 |

|

Item 9C. |

Disclosure Regarding Foreign Jurisdictions that Prevent Inspections |

42 |

|

|

|

PART III |

|

|

Item 10. |

43 |

|

Item 11. |

43 |

|

Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

43 |

Item 13. |

Certain Relationships and Related Transactions, and Director Independence |

43 |

Item 14. |

43 |

|

|

|

|

PART IV |

|

|

Item 15. |

44 |

|

Item 16. |

46 |

i

Special Note Regarding Forward-Looking Statements and Certain Definitions

This Annual Report on Form 10-K includes express or implied forward-looking statements. Forward-looking statements include all statements that are not historical facts including those that reflect our current views with respect to, among other things, our operations and financial performance. Forward-looking statements are included throughout this Annual Report on Form 10-K and relate to matters such as our industry, business strategy, goals, acquisitions and expectations concerning our market position, future operations, margins, profitability, capital expenditures, liquidity and capital resources, and other financial and operating information. We have used the words “anticipate,” “assume,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “potential,” “predict,” “project,” “future,” “will,” “seek,” “foreseeable,” the negative version of these words or similar terms and phrases to identify forward-looking statements in this Annual Report on Form 10-K. The forward-looking statements contained in this Annual Report on Form 10-K are based on management’s current expectations and are not guarantees of future performance. Our expectations and beliefs are expressed in management’s good faith, and we believe there is a reasonable basis for them, however, the forward-looking statements are subject to various known and unknown risks, uncertainties, assumptions, or changes in circumstances that are difficult to predict or quantify. Actual results may differ materially from these expectations due to changes in global, regional, or local economic, business, competitive, market, regulatory, and other factors, many of which are beyond our control.

Important factors that could cause actual results to differ materially from the forward-looking statements made in this Annual Report on Form 10-K include but are not limited to: the almost exclusive focus of our business on the aerospace and defense industry; our heavy reliance on certain customers for a significant portion of our sales; the fact that we have in the past consummated acquisitions and our intention to continue to pursue acquisitions, and that our business may be adversely affected if we cannot consummate acquisitions on satisfactory terms, or if we cannot effectively integrate acquired operations; and other factors.

The terms “Company,” “Loar,” “we,” “us,” “our” and similar terms, unless the context otherwise requires, refer to Loar Holdings Inc. together with Loar Group Inc. and its other subsidiaries.

In addition, as used in this Annual Report on Form 10-K, unless the context requires otherwise requires:

“AAI” refers to Applied Avionics, LLC, a Delaware LLC, which was formerly known as Applied Avionics, Inc.;

“Adjusted EBITDA” mean EBITDA plus, as applicable for each relevant period, certain adjustments as set forth in the reconciliations of net loss to EBITDA and Adjusted EBITDA;

“Adjusted EBITDA Margin” refer to Adjusted EBITDA divided by net sales;

“Board” refers to our board of directors;

“CAV” refers to CAV Systems Group Limited;

“Credit Agreement” refers to our Sixteenth Amendment to Credit Agreement, dated as of August 26, 2024, by and among Loar Group Inc., Loar Holdings Inc., the other guarantors party thereto from time to time, the lenders party thereto from time to time and First Eagle Alternative Credit, LLC, as administrative agent (the “Administrative Agent”) for the lenders and as collateral agent for the secured parties, as amended, restated, supplemented or otherwise modified;

“DAC” refers to DAC Engineered Products, LLC;

“Delayed Draw Term Loan Commitment” refers to the meaning assigned to such term in the Credit Agreement;

“Delayed Draw Term Loans” refers to the meaning assigned to such term in the Credit Agreement;

“EBITDA” mean earnings before interest, taxes, depreciation and amortization;

“DOD” refers to the U.S. Department of Defense;

“Exchange Act” refers to the Securities Exchange Act of 1934, as amended;

“FAA” refers to the Federal Aviation Administration in the United States;

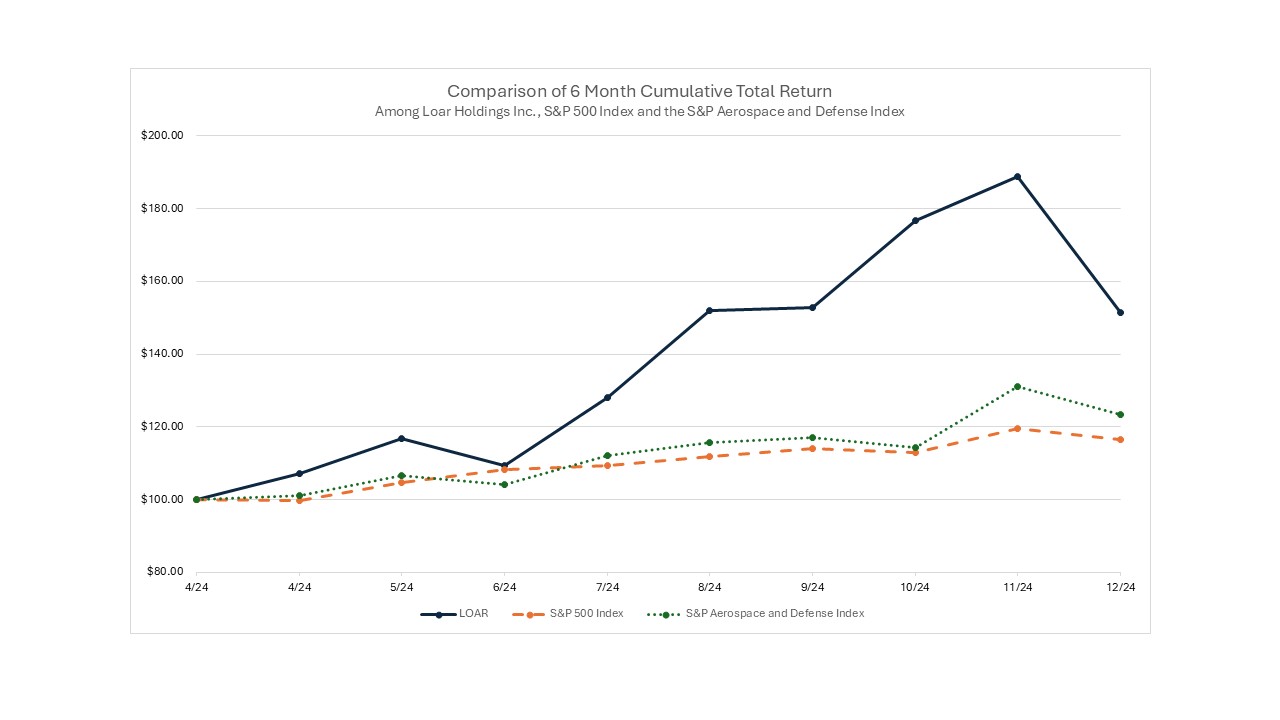

“Follow-On Offering" refers to the Company’s follow-on SEC-registered underwritten equity offering, which closed on December 12, 2024;

1

“GAAP” refers to U.S. generally accepted accounting principles;

“IPO” refers to the Company’s SEC-registered underwritten initial public offering (IPO), which closed on April 29, 2024;

“JLL” refers to JLL Partners;

“JOBS Act” refers to The Jumpstart Our Business Startups Act of 2012;

“K&F” refers to K&F Industries;

“McKechnie” refers to McKechnie Aerospace;

“OEMs” refers to original equipment manufacturers;

“Revenue Passenger Kilometers” and “RPKs” refer to revenue paying passengers multiplied by the distance travelled in kilometers;

“Revolving Line of Credit” refers to the revolving line of credit under the Credit Agreement;

“Sarbanes-Oxley Act” refers to the Sarbanes-Oxley Act of 2002, as amended;

“TransDigm” refers to TransDigm Group Incorporated; and

“Voting Agreement” refers to the Voting Agreement, by and between Loar Holdings Inc., funds advised by Abrams Capital Management, L.P., GPV Loar LLC, Dirkson Charles and Brett Milgrim, dated as of April 29, 2024.

Summary of Risk Factors

Investing in our common stock involves a high degree of risk. You should carefully consider all of the risks described in “Risk Factors” before deciding to invest in our common stock. If any of the risks actually occur, our business, results of operations, prospects, and financial condition may be materially adversely affected. In such case, the trading price of our common stock may decline and you may lose part or all of your investment. Below is a summary of some of the principal risks we face:

our business focuses almost exclusively on the aerospace and defense industry;

we rely heavily on certain customers for a significant portion of our sales;

we have in the past consummated acquisitions and intend to continue to pursue acquisitions, and our business may be adversely affected if we cannot consummate acquisitions on satisfactory terms, or if we cannot effectively integrate acquired operations;

we depend on our executive officers, senior management team and highly trained employees and any work stoppage, difficulty hiring similar employees, or ineffective succession planning could adversely affect our business;

our sales to manufacturers of aircraft are cyclical, and a downturn in sales to these manufacturers may adversely affect us;

our business depends on the availability and pricing of certain components and raw materials from suppliers;

our operations depend on our manufacturing facilities, which are subject to physical and other risks that could disrupt production;

our business may be adversely affected if we were to lose our government or industry approvals, if more stringent government regulations were enacted or if industry oversight were to increase;

our commercial business is sensitive to the number of flight hours that our customers’ planes spend aloft, the size and age of the worldwide aircraft fleet and our customers’ profitability, and these items are, in turn, affected by general economic and geopolitical and other worldwide conditions;

technology failures or cyber security breaches or other unauthorized access to our information technology systems or sensitive or proprietary information could have an adverse effect on the Company’s business and operations;

our inability to adequately enforce and protect our intellectual property or defend against assertions of infringement could prevent or restrict our ability to compete;

2

we could incur substantial costs as a result of violations of or liabilities under environmental laws and regulations;

tariffs on certain imports to the United States and other potential changes to U.S. tariff and import/export regulations may have a negative effect on global economic conditions and our business, financial results and financial condition;

our indebtedness, which is subject to variable interest rates, could adversely affect our financial health and could harm our ability to react to changes to our business;

to service our indebtedness, we will require a significant amount of cash, and our ability to generate cash depends on many factors beyond our control, and any failure to meet our debt service obligations could harm our business, financial condition and results of operations;

pursuant to the Voting Agreement, Abrams Capital, GPV Loar LLC, Dirkson Charles and Brett Milgrim directly control a majority of the voting power of the shares of our common stock eligible to vote in the election of our directors, and their interests may conflict with ours or yours in the future; and

the other factors discussed under “Risk Factors.”

3

PART I

Item 1. Business.

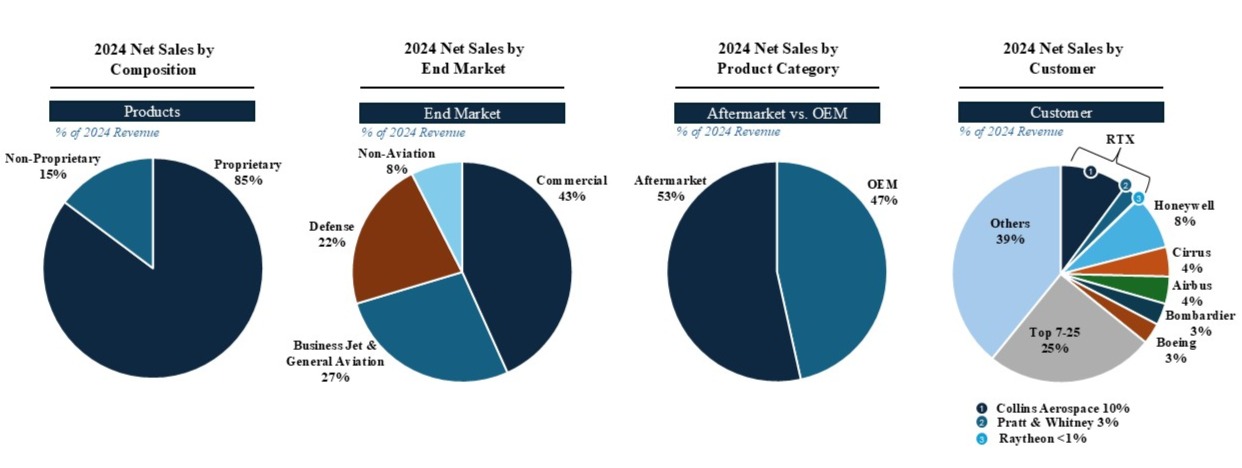

Our Company

We specialize in the design, manufacture, and sale of niche aerospace and defense components that are essential for today’s aircraft and aerospace and defense systems. Our focus on mission-critical, highly engineered solutions with high-intellectual property content resulted in approximately 85% of our 2024 net sales being derived from proprietary products where we believe we hold market-leading positions. Furthermore, our products have significant aftermarket exposure, which has historically generated predictable and recurring revenue. We estimate that approximately 53% of our 2024 net sales were derived from aftermarket products.

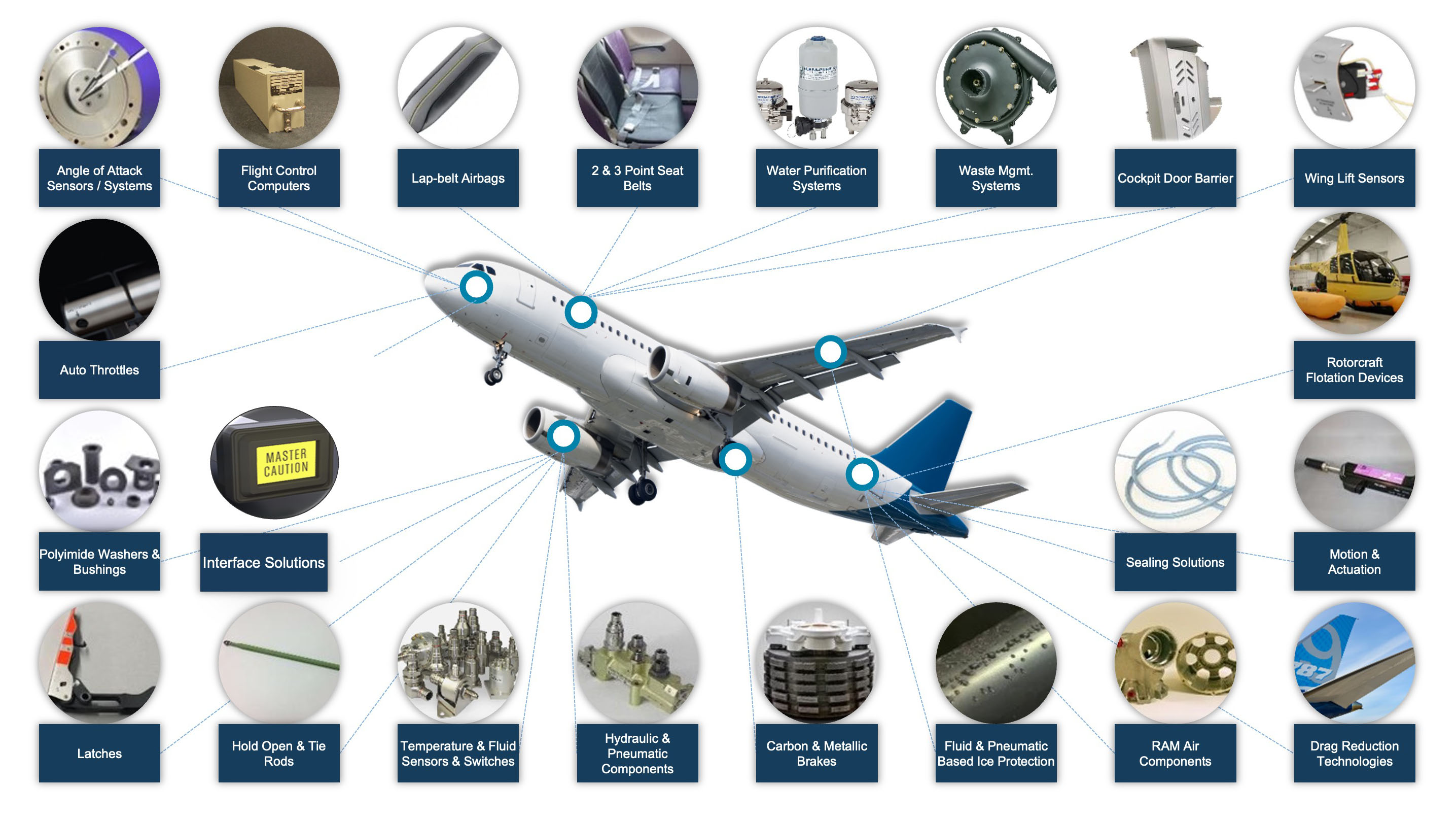

The products we manufacture cover a diverse range of applications supporting nearly every major aircraft platform in use today and include auto throttles, lap-belt airbags, two- and three-point seat belts, water purification systems, fire barriers, polyimide washers and bushings, latches, hold-open and tie rods, temperature and fluid sensors and switches, carbon and metallic brake discs, fluid and pneumatic-based ice protection, RAM air components, sealing solutions and motion and actuation devices, customized edge-lighted panels and knobs and annunciators for incandescent and LED illuminated pushbutton switches, among others. We primarily serve three core end markets: commercial, business jet and general aviation, and defense, which have long historical track records of consistent growth. We also serve a diversified customer base within these end markets where we maintain long-standing customer relationships. We believe that the demanding, extensive and costly qualification process for new entrants, coupled with our history of consistently delivering exceptional solutions for our customers, has provided us with leading market positions and created significant barriers to entry for potential competitors. By utilizing differentiated design, engineering, and manufacturing capabilities, along with a highly targeted acquisition strategy, we have sought to create long-term, sustainable value with a consistent, global business model.

Our ability to deliver high-quality solutions stems from management’s extensive industry experience and their long history of creating value across multiple businesses. Prior to the formation of Loar, Chief Executive Officer and Co-Chairman Dirkson Charles, Chief Financial Officer (CFO) Glenn D’Alessandro, and VP & General Counsel Michael Manella helped lead K&F through 17 years of sustained success, including its initial public offering and ultimate sale to Meggitt plc (now part of Parker-Hannifin Corporation). The team, building upon its proven ability to create value, subsequently worked together at McKechnie until its 2010 sale to TransDigm. During their tenure at McKechnie, they worked alongside the Company’s Co-Chairman Brett Milgrim, who was a Managing Director and Partner of JLL, McKechnie’s majority owner before the sale to TransDigm. Through their collective experience at K&F and McKechnie, the management team built deep industry expertise and harnessed this knowledge to launch Loar, even entering some of the same product categories as K&F and McKechnie such as carbon and metallic brake discs, hydraulic valves, keepers, rate control devices, latches, hold-open rods, starter generators, and actuators, among others. By having the advantage of a clean blueprint and targeted list of attractive product categories and acquisition candidates, the management team has been able to leverage its significant experience to create a purpose-built, successful platform.

Loar is centered around a commitment to a consistent and focused business model—creating a portfolio of proprietary products serving a highly diverse set of applications, end markets and customers within the aerospace and defense value chain. This strategy has resulted in what we believe to be market-leading positions, driven by products that have been difficult for competitors to replicate. The qualification process for the Company’s products serves as a significant barrier to entry for new suppliers. The time, investment, and risks associated with qualification are substantial. The process can often take years, involving multiple tests that require support and financial contribution from both the system supplier and the OEM. Moreover, the Company focuses on products that make up a relatively small portion of the total cost of an aircraft. As a result, it is not typically economical for OEMs to repeat the process of qualification after an existing supplier has been qualified already onto a given aircraft platform. In addition, customer relationships represent a key barrier to entry. Given the mission-critical nature of the Company’s products, we believe our customers look for highly reliable suppliers they can trust to deliver on-time, high-quality solutions. Loar’s position as a trusted supplier of highly engineered, value-added products not only has created significant barriers to entry, but also has established an ability to fairly value our products, which has resulted in consistent improvements to Loar’s gross profit margins over the long-term.

4

Our portfolio of products serves a variety of applications across aircraft platforms as shown below:

Once Loar’s components are qualified on an aircraft platform, we believe we are likely to maintain our position as the provider of aftermarket parts and services for the life of the platform and related platform derivatives. This results in significant aftermarket revenue, which represented 53% of our 2024 net sales. For the platforms we serve, the total life of an aircraft can be up to 50 years, ensuring steady aftermarket revenue streams with historically higher margins than revenue to OEM customers. We believe our aftermarket exposure provides us with an opportunity for stable, recurring, long-lasting and high-margin financial performance.

In addition to our OEM and aftermarket balance, our revenue is diversified across end markets, customers, and platforms. No more than 13% of our 2024 net sales came from any single customer, and no more than 7% of our 2024 net sales came from any single aircraft platform. We believe that our revenue diversification provides significant resiliency, and it positions us well to take advantage of new business opportunities.

We believe that our efforts to serve our customers effectively have also differentiated our business and led to long-standing customer relationships. Given the complexity of our customers’ supply chains, they look for dependable suppliers across multiple products and capabilities. In addition to providing a broad set of capabilities, we believe our commitment to quality, consistent on-time delivery and

5

highly specialized tailored solutions furthers our long-standing relationships. Our relationships enable an open dialogue regarding our customers’ supply chain challenges, which can give us insight into potential growth opportunities, both organically and inorganically.

Our business approach couples strong organic growth with our proven acquisition strategy. Since 2012, we have executed and successfully integrated 17 strategic acquisitions. We have a highly disciplined approach to evaluating potential acquisition targets, and have sought companies with valuable intellectual property, high aftermarket content, revenue synergies, ability to cross-sell and strong customer relationships. We operate in a highly fragmented market, which has historically provided ample acquisition targets as we look to enhance and grow our platform.

On March 7, 2025, we entered into a purchase agreement to acquire LMB Fans & Motors ("LMB"), which is a global specialty player in the design and production of customized high-performance fans and motors. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Recent Developments.”

Our Industry

End Markets

We primarily compete across three core end markets of the aerospace and defense component industry: commercial, business jet and general aviation, and defense.

Commercial. The commercial aerospace market, our largest end market representing approximately 43% of 2024 net sales, has experienced significant growth over the past several years as a result of increased orders for next-generation commercial aircraft and increased aftermarket requirements from higher levels of aircraft usage in a post-COVID environment. However, the commercial aerospace market has shown consistent long-term growth trends over the past 75 years, spurred by travel demand and the development of a global world economy. The industry’s growth rate has historically outpaced global GDP growth, with RPKs increasing at an average of 1.6x global GDP growth between 1970 and 2022, reflecting an approximate 5% compound annual growth rate (“CAGR).

Commercial OEM revenue historically has been tied to new aircraft production, which is currently supported by the production ramp of several next-generation narrowbody aircraft programs that have large order backlogs (for example, Airbus A320 family and Boeing 737 family). These order backlogs are needed to meet the secular demand for air travel. In 2024, there were 28,000 commercial jet aircraft in service, compared to 17,712 commercial jet aircraft in service in 2010, and industry consultants project that future demand requires 50,170 commercial aircraft in service by 2043.

The commercial aftermarket has historically produced consistent revenue. In our experience, as global commercial aircraft fleets grow, maintenance requirements grow alongside them. Most maintenance requirements are recurring and non-deferrable, even during periods of economic downturn or reduced demand for commercial air travel. Given the industry’s long-term secular growth trends, an increasingly larger middle class that has a high demand for travel, and a meaningfully large share of the global fleet represented by legacy aircraft, we expect continued growth and stability of our commercial aftermarket revenue.

Business Jet and General Aviation. Our second largest end market, business jet and general aviation, which accounted for approximately 27% of 2024 net sales, has experienced significant growth over the past several years. The emergence of several business models has provided consumers with greater accessibility and affordability to private aviation, driving increased popularity globally.

6

The business jet and general aviation market is comprised of all aviation operations outside of commercial and defense, and it includes both OEM and the aftermarket. This market has experienced strong demand with new asset-light fleet models, such as charter operators, jet cards and fractional jet ownership. These shared economy solutions have increased average utilization, resulting in growing demand for new aircraft. Accordingly, several modern, next-generation business jet platforms have been introduced by aircraft OEMs and production rates have been rising to meet this growing demand. Moreover, increased accessibility and affordability of private aviation has driven accelerated adoption by consumers, as flyers seek alternative options to commercial air travel, resulting in even greater flight hours and aftermarket growth.

Defense. The defense end market, which accounted for approximately 22% of 2024 net sales, has continued to benefit from growing global demand. Current geopolitical circumstances, including the Ukraine conflict, the Israeli war and the potential for engagements with China and/or Russia have resulted in increased global defense spending. We expect that defense spending will continue to increase as militaries invest to maintain operational readiness.

We believe that aftermarket and OEM demand for defense solutions follows global defense spending and the broader U.S. Department of Defense budget. OEM defense revenue is primarily driven by spending on new aircraft platforms and systems. In an era of heightened geopolitical instability, we believe that defense spending will continue to be a priority for militaries to maintain operational readiness and invest in next-generation platforms with modern capabilities. Recently, defense aftermarket revenue has been derived primarily from utilization of existing aircraft, aircraft modernization and sustainment initiatives to upgrade existing fleets and extend the service life of equipment.

Competition

The market for aerospace and defense components is highly fragmented, with few scaled competitors. As a result, we have very few direct competitors that provide the breadth of products, solutions and expertise that we are able to offer our customers. However, given the market fragmentation, we face competition from different competitors across individual products and applications. Competition within our product offerings range from divisions of large public corporations to small, privately held companies with singular capabilities that lack infrastructure and capacity to scale.

We compete primarily on the basis of engineering, capabilities, capacity and customer responsiveness. We believe we meet or exceed the performance and quality requirements of our customers and consistently deliver products on a timely basis with superior customer service and support. Our commitment to performance and responsiveness has allowed us to foster strong customer relationships with major aerospace and defense OEMs and Tier 1 and Tier 2 suppliers. We believe that our consistent quality, performance and breadth of capabilities are key reasons that enable us to win new business and fuel the continued long-term relationships with our customers.

Challenges

Our business is subject to a number of risks inherent to our industry, including, among others, our almost exclusive focus on the aerospace and defense industry, our ability to consummate acquisitions on satisfactory terms and to integrate effectively acquired operations and the cyclical nature of our sales to manufacturers of aircraft. Any number of these factors could impact our business, and there is no guarantee that our historical performance will be predictive of future operational and financial performance. For a description of the challenges we have faced and continue to face and the risks and limitations that could harm our prospects, see “Cautionary Note Regarding Forward-Looking Statements,” “Summary of Risk Factors” and “Risk Factors” included elsewhere in this 10-K.

Competitive Strengths

As a specialized supplier in the aerospace and defense component industry, we believe we are well-positioned to deliver innovative, mission-critical solutions to a wide array of aerospace and defense customers. Our key competitive strengths support our ability to offer differentiated solutions to our customers:

Portfolio of Mission-Critical, Niche Aerospace and Defense Components. We specialize in niche aerospace and defense components that are essential for the production and maintenance of aircraft and their related systems. Given the high costs typically associated with the stoppage of production or the removal of an aircraft from service, customers demand consistent reliability, performance and quality from our products. We believe that few competitors can offer the customized, high-quality solutions we provide and, as such, we believe we are the supplier of choice in the end markets in which we operate.

Intellectual Property-Driven, Proprietary Products and Expertise in an Industry with High Barriers to Entry. We derived 85% of our 2024 net sales from proprietary products or solutions. Our intellectual property and in-house expertise represent decades of knowledge and investment that we believe competitors would struggle to match. Furthermore, due to the industry’s stringent regulatory, certification and technical requirements, the qualification process for new products is rigorous and costly. Certification processes necessitate significant time and monetary investments from both suppliers and customers, leaving little incentive for either party to repeat these processes once a product is already certified on a platform. Accordingly, we believe that these high barriers to entry provide us with additional growth opportunities with our customers, while the reliability, performance and quality of our products enhance our long-standing customer relationships.

7

Strategically Focused on Higher-Margin Aftermarket Content. We supply aftermarket products to a large installed, and growing, base of aircraft. We estimate that our addressable market opportunity includes more than 84,000 discrete aircraft across more than 250 total aircraft platforms. Due to our installed OEM base of proprietary products and a demanding certification process, we are often the only supplier providing these products in the aftermarket, which we generally expect to result in a recurring revenue stream for the life of each aircraft platform. The total life of the platforms we serve can be up to 50 years, presenting the opportunity for a long tail of aftermarket service and/or periodic replacement requirements. We believe our ability to support the full aircraft life cycle from initial build to retirement is a key differentiator and has historically generated significant revenue, as represented by the 53% of our 2024 net sales attributable to the aftermarket. The long-term secular growth dynamics of aftermarket demand historically have also led to higher margins and consistent revenue growth.

Highly Diversified Revenue Streams. We have strategically and purposefully constructed a highly diverse portfolio, which we believe positions us well to succeed in a variety of market conditions. Our diversified revenue base is designed to reduce our dependence on any particular product, platform, or market sector, and we believe it has been a significant factor in our resilient financial performance. The Company’s diversification stretches across end markets, product category or application, customers, and platforms.

Established Business Model with a Lean, Entrepreneurial Structure. Our operations are built around a philosophy that encourages local autonomy across the Company’s brands and drives entrepreneurial spirit. Critical to our success is a management structure that is designed to facilitate seamless communication across our businesses. Executive Vice Presidents are responsible for multiple brands within the Company. They support local brand leaders and also work closely with corporate management in helping to optimize potential cross-selling opportunities, operational initiatives and capital allocation. By fostering cross-communication and enabling each brand to leverage the benefits of the broader Company platform, we have created a highly scalable operational structure with few management layers. We believe our streamlined structure also facilitates efficient decision making for acquisitions and other important strategic decisions. Our streamlined leadership, coupled with a holistic approach to revenue and innovation, is intended to position us for revenue growth and ongoing operational improvements.

Disciplined and Strategic Approach to Acquisitions, with History of Successful Integration. We have a disciplined and thoughtful approach to acquisitions, as demonstrated by the successful integration of our 17 acquisitions since 2012. Our well-defined acquisition criteria have led us to target companies with proprietary products and/or processes, leading market positions, significant aftermarket potential, strong revenue synergies with potential for cross-selling and strong customer relationships. Management’s experience in driving financial performance from our defined model has led to a targeted goal of doubling an acquired business’s Adjusted EBITDA over a three-to-five-year time frame post-acquisition. Our focused approach to acquisitions and the underlying drivers of value have helped create a scaled and integrated platform.

Track Record of Strong Growth, Margins and Cash Flow Generation. Since inception, we have utilized both organic and inorganic drivers to generate a portfolio of what we believe to be market leading brands and products under the Loar umbrella, enabling a consistent track record of growth and strong margins. In constructing a portfolio of capabilities that fit the needs of the marketplace, we have focused on four main strategic drivers of value in our business: launching new products, optimizing productivity, achieving value pricing and readying talent. By applying these drivers, we have been able to generate significant growth, high margins and high cash flow since our inception. We believe our performance-driven culture and commitment to constant improvement and execution will continue to drive strong financial performance.

Proven Leadership Team. Our leadership team has a depth of experience running businesses in the aerospace and defense component industry. A core group of our senior management team has worked together for over 30 years at multiple companies, and the average industry experience for 10 members of our senior leadership team is over 25 years, including having worked together for more than 15 years at the Company, McKechnie and/or TransDigm. Our management team has leveraged its extensive industry experience to construct purposely a well-designed and diversified platform at Loar, has generated significant net sales growth, and has navigated many different market environments. In addition, our management team’s incentives are well-aligned with the success of Loar and its stockholders. Members of the management team and certain other key employees hold approximately 15% of the shares of our common stock outstanding as of December 31, 2024.

8

Growth Strategy

Our growth strategy is made up of two key elements: (i) a value-driven operating strategy and (ii) a disciplined acquisition strategy.

Value-driven operating strategy. Our five core organic growth value drivers are:

Disciplined acquisition strategy. Acquisitions are a core element of our long-term growth strategy. We have considerable experience in executing acquisitions and integrating acquired businesses into our Company and culture, having done so 17 times since our formation in 2012. Our disciplined acquisition strategy revolves around acquiring aerospace and defense component businesses with significant aftermarket potential and proprietary content and/or processes, where we believe there is a clear path to value creation.

The aerospace supply chain is highly fragmented, with many components supplied by smaller privately-owned businesses that, in turn, sell to system integrators, Tier 1 or Tier 2 manufacturers, or large OEM participants. We believe there is a significant opportunity for further consolidation of the supply chain. We have maintained a robust pipeline of acquisition targets and are often in active discussions with business owners that recognize our established culture and the opportunity for them to leverage the Company’s existing infrastructure, customer base, platform exposure and industry relationships. We are positioned as an acquirer of choice due to our entrepreneurial philosophy and desire to further grow and improve each brand we acquire, based on a flexible post-acquisition integration that suits each business’s specific strengths and culture. We intentionally maintain each acquired business’s brand to preserve long-term customer relationships and capture revenue synergies.

As part of our acquisition strategy, we take a disciplined approach to acquisition target screening, focusing on identifying key characteristics that we believe provide insight on strategic fit. Such characteristics include: (i) aerospace- and defense-focused businesses; (ii) proprietary content and/or processes; (iii) significant aftermarket exposure or potential to grow; (iv) focus on niche markets or products with strong market positions; (v) capabilities where the opportunity to cross-sell our existing portfolio of products exists; and (vi) long-standing customer relationships. Our disciplined approach to acquisitions has allowed us to be opportunistic, which has built the Company into a leading aerospace and defense component supplier.

9

Government Contracts

We supply defense-related equipment and services to U.S. Government agencies and therefore are subject to the business risks specific to the defense industry, including the ability of the U.S. Government to unilaterally: (1) suspend us from receiving new contracts; (2) terminate existing contracts at its convenience and without significant notice; (3) reduce the value of existing contracts; (4) audit our contract-related costs and fees, including allocated indirect costs; and (5) revoke required security clearances. We also sell directly to the government of Germany. Violations of government procurement laws could result in civil or criminal penalties. Sales to U.S. government agencies accounted for approximately 3% of our net sales during the year ended December 31, 2024.

Governmental Regulation

As a manufacturer and supplier of commercial aircraft components and equipment, we are subject to regulation by the FAA, the European Union Aviation Safety Agency, UK Civil Aviation Authority, and the Civil Aviation Administration of China, while the military aircraft component industry is governed by military quality specifications.

The components we manufacture are required to be certified by one or more of these entities or agencies, and other similar agencies elsewhere in the world. We must also satisfy the requirements of our customers, including OEMs and airlines that are subject to FAA regulations, and provide these customers with products and services that comply with the government regulations applicable to commercial flight operations. These regulations are largely designed to ensure that all aircraft components and equipment are continuously maintained and in proper condition to ensure safe operation of the aircraft. Specifically, the FAA and other aviation authorities require that various maintenance routines be performed on aircraft engines, engine parts, airframes and other components at regular intervals based on cycles or flight time. The inspection, maintenance and repair procedures for the various types of aircraft and equipment can be performed only by certified repair facilities utilizing certified technicians. We believe that we currently satisfy or exceed these maintenance standards in our repair and overhaul services.

Since we sell defense products directly to the U.S. Government and for use in systems delivered to the U.S. Government, we can be subject to various laws and regulations governing pricing and other factors as well. Contracting in the defense industry also makes us subject to rules related to bidding, billing and accounting kickbacks and false claims.

Furthermore, we are at times subject to trade laws and regulations like the Arms Export Control Act, the International Traffic in Arms Regulations, the Export Administration Regulations, and the sanctions administered by the United States Department of the Treasury’s Office of Foreign Assets Control. Additionally, we are subject to data protection laws, including but not limited to the General Data Protection Regulation, the California Consumer Privacy Act, the European Union General Data Protection Regulation, and the Personal Information Protection Law in China.

There has been no material adverse effect to our consolidated financial statements nor competitive positions as a result of these governmental regulations. Our operations may in the future be subject to new and more stringent regulatory requirements, so in that regard, we closely monitor the FAA and industry trade groups to attempt to understand how possible future regulations might impact us.

Manufacturing and Engineering

We continually strive to optimize productivity and achieve value pricing over inflation, implementing precision engineering and manufacturing to produce parts essential for today’s aircraft systems and structures. We strive to differentiate ourselves from our competitors by manufacturing products in an accurate, reliable and repeatable manner without sacrificing attention to detail, which is evident in the durability and precision of our products. We are able to keep capital expenditure levels low since we do not constantly need new state of the art equipment, which contributes to our lean entrepreneurial structure and helps us drive continuous improvement.

Raw Materials

We require the use of a variety of raw materials and manufactured component parts in our manufacturing processes, and we purchase these from various suppliers. We believe most of our raw materials and component parts are generally available from multiple suppliers at competitive prices. From time-to-time various events (such as geopolitical tension, upstream supply chain disruptions, etc.) may temporarily impair our ability to manufacture our products for our customers or require us to pay higher prices to obtain these raw materials from other sources, however, we believe that the loss of any one source, although potentially disruptive in the short-term, would not materially affect our long-term operations. We try to limit the volume of raw materials and component parts on hand, and we are highly dependent on the availability of essential materials, so continued inflationary pressures could impact material costs. Although we believe in most cases that we could identify alternative suppliers, or alternative raw materials or component parts, the lengthy and expensive FAA and OEM certification processes associated with aerospace products could prevent efficient replacement of a supplier, raw material or component part. Additionally, an open conflict or war across any region, including, but not limited to, the conflicts in Ukraine and Israel, could affect our ability to obtain raw materials.

10

Intellectual Property

We rely on patents, trademarks, trade secrets and proprietary knowledge and technology, both internally developed and acquired, in order to maintain a competitive advantage. The Company’s products are manufactured, marketed and sold using a portfolio of patents, trademarks, and other forms of intellectual property, some of which expire in the future. The Company develops and acquires new intellectual property on an ongoing basis. Based on the broad scope of the Company’s product lines, management believes that the loss or expiration of any single intellectual property right would not have a material effect on our consolidated financial statements.

As of December 31, 2024, we own 98 issued patents, which will expire between April 2, 2025 and February 22, 2041. We currently have 35 pending or published but not yet issued patents, for which the rights and duration are pending grant of the patent by the U.S. Patent and Trademark Office or other applicable national or regional patent authority. Additionally, as of December 31, 2024, we have 186 submitted trademark applications, all of which have been issued and none of which are pending.

Environmental Matters

Our operations and facilities are subject to an extensive regulatory framework of federal, state, local and foreign environmental laws and regulations that govern, among other things, discharges of pollutants into the air and water, the generation, handling, storage and disposal of hazardous materials and wastes, the investigation and remediation of certain materials, substances, and wastes. We are committed to monitoring our business’s environmental performance, and to the health and safety of our employees, and as such we continually make efforts to ensure our operations are in substantial compliance with all applicable environmental laws and regulations. Environmental laws and regulations may require that the Company investigate and remediate the effects of the release or disposal of materials at sites associated with past and present operations. We recorded an environmental liability in connection with our acquisition of AGC Acquisition LLC, for which we are not entitled to any third-party recoveries. The facilities acquired in connection with that acquisition entered into the state of Connecticut’s voluntary remediation program for certain known contaminants in 2009. An independent third-party evaluation of the facilities estimated the potential range of costs for remediation, and consistent with that original estimate and with progress made on the remediation process since then (and taking into account new information learned about the site since that estimate was prepared), the balance of the environmental liability on December 31, 2024 was approximately $0.1 million.

Based upon consideration of currently available information, we believe liabilities for environmental matters will not have a material adverse impact on our consolidated financial statements, but we cannot assure that material environmental liabilities may not arise in the future. For further information on environmental-related risks, including climate change, see “Risk Factors.”

Human Capital Resources

As of December 31, 2024, we had approximately 1,500 full-time, part-time and temporary employees. Approximately 135 of our full-time and part-time employees are represented by labor unions. One collective bargaining agreement between us and a labor union expires on October 31, 2025 and one agreement, covering approximately 55 employees, does not have an expiration.

Our employees are critical to our long-term success and are essential to helping us meet our goals. Therefore, it is crucial that we continue to attract, retain and motivate exceptional and high-performing employees by providing opportunities available for all our employees to not only contribute to Loar, but also grow and develop in their careers. We offer training and development programs encouraging advancement from within in order to support the advancement of our employees. We leverage both formal and informal programs to identify, foster, and retain top talent at both the corporate and operating unit level. We believe we offer competitive compensation programs to our employees to help attract and retain our employees.

Seasonality

We do not believe our net sales are subject to significant seasonal variation.

Available Information

Our website address is https://www.loargroup.com. We make available free of charge, through the Investors section of our website, our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, registration statements on Form S-8 and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934 as soon as reasonably practicable after we electronically file such material with, or furnish it to, the Securities and Exchange Commission (“SEC”). These materials are also available free of charge on the SEC’s website at http://www.sec.gov. The information on or obtainable through our website is not incorporated into this Annual Report on Form 10-K.

11

PART II—OTHER INFORMATION

Item 1. Legal Proceedings

None.

Item 1A. Risk Factors

Investing in our common stock involves a high degree of risk. Before making an investment decision, you should carefully consider the risks and uncertainties described below, together with the other information contained in our audited financial statements and the related notes, as well as the information in the section entitled “Item 7. “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” These material risks and uncertainties could negatively affect our business and financial condition and could cause our actual results to differ materially from those expressed in forward-looking statements contained in this Annual Report on Form 10-K. The risks and uncertainties described below are not the only ones we face. Additional risks and uncertainties not presently known to us, or that we currently believe are immaterial, also may impair our business operations and financial condition. In that event, the trading price of our common stock could decline, and you could lose part, or all, of your investment.

Risks Related to Our Strategy

Our business focuses almost exclusively on the aerospace and defense industry.

During a prolonged period of significant market disruption in the aerospace and defense industry, such as the adverse impact the COVID-19 pandemic had on the commercial aerospace market, and other macroeconomic factors such as when recessions occur, our business may be disproportionately impacted compared to companies that are more diversified in the industries they serve. A more diversified company with significant sales and earnings derived from outside the aerospace and defense sector may be able to recover more quickly from significant market disruptions.

We rely heavily on certain customers for a significant portion of our sales.

Our customers are concentrated in the aerospace industry. Our two largest customers accounted for approximately 21% of net sales during the year ended December 31, 2024. A material reduction in purchasing by one of our larger customers for any reason, including, but not limited to, general economic or aerospace market downturn, decreased production, strike, or resourcing, or the effects of global economic crises such as the COVID-19 pandemic could have a material adverse effect on results of operations, financial position and cash flows.

We have in the past consummated acquisitions and intend to continue to pursue acquisitions. Our business may be adversely affected if we cannot consummate acquisitions on satisfactory terms, or if we cannot effectively integrate acquired operations.

A significant portion of our growth has occurred through acquisitions. Any future growth through acquisitions will be partially dependent upon the continued availability of suitable acquisition candidates at favorable prices and upon advantageous terms and conditions. We intend to pursue acquisitions that we believe present opportunities consistent with our overall business strategy. However, we may not be able to find suitable acquisition candidates to purchase or may be unable to acquire desired businesses or assets on acceptable terms or at all, including due to a failure to receive necessary regulatory approvals. In addition, we may not be able to raise the capital necessary to fund future acquisitions. Because we may actively pursue a number of opportunities simultaneously, we may encounter unforeseen expenses, complications and delays, including regulatory complications or difficulties in employing sufficient staff and maintaining operational and management oversight.

We regularly engage in discussions with respect to potential acquisition and investment opportunities. If we consummate an acquisition, our capitalization and results of operations may change significantly. Future acquisitions could result in margin dilution and likely result in the incurrence of additional debt and an increase in interest and amortization expenses or periodic impairment charges related to goodwill and other intangible assets as well as significant charges relating to integration costs.

The businesses we acquire may not perform in accordance with expectations and our business judgments concerning the value, strengths and weaknesses of businesses acquired may prove incorrect. In addition, we may not be able to successfully integrate any business we acquire into our existing business. The successful integration of new businesses depends on our ability to manage these new businesses and bring operating and compliance standards to levels consistent with our existing businesses. Assimilating operations and products may be unexpectedly difficult. The successful integration of future acquisitions may also require substantial attention from our senior management and the management of the acquired business, which could decrease the time that they have to serve and attract customers, develop new products and services or attend to other acquisition opportunities. Additional potential risks include that we may lose key employees, customers or vendors of an acquired business, and we may become subject to pre-existing liabilities and obligations of the acquired businesses.

12

We depend on our executive officers, senior management team and highly trained employees, and any work stoppage, difficulty hiring similar employees, or ineffective succession planning could adversely affect our business.

Because our products are highly engineered, we depend on an educated and trained workforce. Historically, substantial competition for skilled personnel in the aerospace and defense industry has existed, and we could be adversely affected by a shortage of skilled employees. We may not be able to fill new positions or vacancies created by expansion or turnover or attract and retain qualified personnel. We may not be able to continue to hire, train and retain qualified employees at current wage rates since we operate in a competitive labor market, and currently significant inflationary and other pressures on wages exist.

Although we believe that our relations with our employees are satisfactory, we may not be able to negotiate a satisfactory renewal of collective bargaining agreements, satisfy workers councils, or maintain stable employee relations. Because we strive to limit the volume of finished goods inventory, any work stoppage could materially and adversely affect our ability to provide products to our customers.

In addition, our success depends in part on our ability to attract and motivate our senior management and key employees. Achieving this objective may be difficult due to a variety of factors, including fluctuations in economic and industry conditions, competitors’ hiring practices, and the effectiveness of our compensation programs. Competition for qualified personnel can be intense. If we are unable to effectively provide for the succession of key personnel, senior management and our executive officers, our business, results of operations, cash flows and financial condition may be adversely affected.

Because our operations are conducted through our subsidiaries, we are dependent on the receipt of distributions and dividends or other payments from our subsidiaries for cash to fund our operations and expenses and future dividend payments, if any.

Our operations are conducted through our subsidiaries. As a result, our ability to make future dividend payments, if any, is dependent on the earnings of our subsidiaries and the payment of those earnings to us in the form of dividends, loans or advances and through repayment of loans or advances from us. Payments to us by our subsidiaries will be contingent upon our subsidiaries’ earnings and other business considerations and may be subject to statutory or contractual restrictions. We do not expect to declare or pay dividends on our common stock for the foreseeable future; however, if we determine in the future to pay dividends on our common stock, the agreements governing our outstanding indebtedness significantly restrict the ability of our subsidiaries to pay dividends or otherwise transfer assets to us.

We may need to raise additional capital, and we cannot be sure that additional financing will be available.

To satisfy existing obligations and support the development of our business, we depend on our ability to generate cash flow from operations and to borrow funds. We may require additional financing for liquidity, capital requirements or growth initiatives. We may not be able to obtain financing on terms and at interest rates that are favorable to us or at all. Any inability by us to obtain financing in the future could have a material adverse effect on our business, financial position, results of operations and cash flows.

In addition, if we were to undertake a substantial acquisition for cash, the acquisition would likely need to be financed in part through additional financing from banks, through offerings of debt or equity securities or through other arrangements. Such acquisition financing might increase our net loss and net loss margin, or decrease our net income, EBITDA, Adjusted EBITDA, net income margin and Adjusted EBITDA Margin and adversely affect our leverage. We cannot assure you that the necessary acquisition financing would be available to us on acceptable terms if and when required.

Our business may be adversely affected by changes in budgetary priorities of the U.S. Government.

Because a significant percentage of our revenue is derived either directly or indirectly from contracts with the U.S. Government, changes in federal government budgetary priorities, such as those announced by President Trump since his inauguration in January 2025, could directly affect our financial performance. A significant decline in government expenditures, a shift of expenditures away from programs that we support or a change in federal government contracting policies could cause federal government agencies to reduce their purchases under contracts, to exercise their right to terminate contracts at any time without penalty or not to exercise options to renew contracts, any of which could result in decreased sales of our products.

We generally do not have guaranteed future sales of our products. Further, when we enter into fixed price contracts with some of our customers, we take the risk for cost overruns.

As is customary in our business, we do not generally have long-term contracts with most of our aftermarket customers and, therefore, do not have guaranteed future sales. Although we have long-term contracts with many of our OEM customers, many of those customers may terminate the contracts on short notice and, in most cases, our customers have not committed to buy any minimum quantity of our products. In addition, in certain cases, we must anticipate the future volume of orders based upon the historic purchasing patterns of customers and upon our discussions with customers as to their anticipated future requirements, and this anticipated future volume of orders may not materialize, which could result in excess inventory, inventory write-downs, or lower margins.

13

We also have entered into multi-year, fixed-price contracts with some of our customers, pursuant to which we have agreed to perform the work for a fixed price and, accordingly, realize all the benefit or detriment resulting from any decreases or increases in the costs of making these products. This risk is greater in a high inflationary environment. Sometimes we accept a fixed-price contract for a product that we have not yet produced, and this increases the risk of cost overruns or delays in the completion of the design and manufacturing of the product. Some of our contracts do not permit us to recover increases in raw material prices, taxes or labor costs.

Risks Related to Our Operations

Our sales to manufacturers of aircraft are cyclical, and a downturn in sales to these manufacturers may adversely affect us.

Our sales to manufacturers of large commercial aircraft, as well as manufacturers of business jets have historically experienced periodic downturns. In the past, these sales have been affected by airline profitability, which is impacted by, among other things, fuel and labor costs, price competition, interest rates, downturns in the global economy and national and international events. In addition, sales of our products to manufacturers of business jets are impacted by, among other things, downturns in the global economy. In recent years, such as in 2021 and the second half of 2020, we experienced decreased sales across the commercial OEM sector, driven primarily by the decrease in production by Boeing and Airbus related to reduced demand in the commercial aerospace industry from the COVID-19 pandemic, and airlines deferring or cancelling orders. Regulatory and quality challenges could also have an adverse impact. Downturns adversely affect our results of operations, financial position and cash flows.

Furthermore, because of the lengthy research and development cycle involved in bringing new products to market, we cannot predict the economic conditions that will exist when a new product is introduced. A reduction in capital spending in the aviation or defense industries could have a significant effect on the demand for our products, which could have an adverse effect on our financial performance or results of operations.

Our business depends on the availability and pricing of certain components and raw materials from suppliers.

Our business is affected by the price and availability of the raw materials and component parts that we use to manufacture our components. Our business, therefore, could be adversely impacted by factors affecting our suppliers (such as the destruction of our suppliers’ facilities or their distribution infrastructure, a work stoppage or strike by our suppliers’ employees or the failure of our suppliers to provide materials of the requisite quality), or by increased costs of such raw materials or components if we were unable to pass along such price increases to our customers.

We currently are experiencing supply shortages and inflationary pressures for certain components and raw materials that are important to our manufacturing process. Expected growth in the global economy may exacerbate these pressures on us and our suppliers, and we expect these supply chain challenges and cost impacts to continue for the foreseeable future. Because we strive to limit the volume of raw materials and component parts on hand, our business would be adversely affected if we were unable to obtain these raw materials and components from our suppliers in the quantities and at the times we require or on favorable terms. Although we believe in most cases that we could identify alternative suppliers, or alternative raw materials or component parts, the lengthy and expensive process to obtain aviation authority and OEM certifications for aerospace products could prevent efficient replacement of a supplier, raw material or component part.

Our operations depend on our manufacturing facilities, which are subject to physical and other risks that could disrupt production.

Our operations and those of our customers and suppliers have been and may again be subject to natural disasters, climate change-related events, pandemics or other business disruptions, which could seriously harm our results of operation and increase our costs and expenses. Some of our manufacturing facilities are located in regions that may experience earthquakes or be impacted by severe weather events, such as increased storm frequency or severity in the Atlantic and fires in hotter and drier climates. These could result in potential damage to our physical assets as well as disruptions in manufacturing activities. Some of our manufacturing facilities are located in areas that may be at risk due to rising sea levels. Moreover, some of our manufacturing facilities are located in areas that could experience decreased access to water due to climate issues, including, but not limited to, our facilities in California.

We are also vulnerable to damage from other types of disasters, including power loss, fire, explosions, floods, communications failures, terrorist attacks and similar events. Disruptions could also occur due to health- related outbreaks and crises, cyber-attacks, computer or equipment malfunction (accidental or intentional), operator error or process failures. Should insurance or other risk transfer mechanisms, such as our existing disaster recovery and business continuity plans, be insufficient to recover all costs, we could experience a material adverse effect on our business, results of operations, financial position and cash flows.

14

Our business may be adversely affected if we were to lose our government or industry approvals, if more stringent government regulations were enacted or if industry oversight were to increase.

The aerospace industry is highly regulated in the U.S. and in other countries. In order to sell our products, we and the products we manufacture must be certified by the FAA, the DOD and similar agencies in foreign countries and by individual manufacturers. If new and more stringent government regulations are adopted or if industry oversight increases, we might incur significant expenses to comply with any new regulations or heightened industry oversight. In addition, if any existing material authorizations or approvals were revoked or suspended, our business would be adversely affected.

We are at times required to obtain approval to export our products from U.S. Government agencies and similar agencies elsewhere in the world. U.S. laws and regulations applicable to us include the Arms Export Control Act, the International Traffic in Arms Regulations (“ITAR”), the Export Administration Regulations (“EAR”) and the sanctions administered by the United States Department of the Treasury’s Office of Foreign Assets Control (“OFAC”). EAR restricts the export of commercial and dual-use products and technical data to certain countries, while ITAR restricts the export of defense products, technical data and defense services.

Failure to obtain approval to export, or a determination by the U.S. Government or similar agencies elsewhere in the world from which we failed to receive required approvals or licenses, could eliminate or restrict our ability to sell our products outside the United States or another country of origin, and the penalties that could be imposed by the U.S. Government or other applicable government for failure to comply with these laws could be significant.

Our commercial business is sensitive to the number of flight hours that our customers’ planes spend aloft, the size and age of the worldwide aircraft fleet and our customers’ profitability. These items are, in turn, affected by general economic and geopolitical and other worldwide conditions.

Our commercial business is directly affected by, among other factors, changes in RPKs, the size and age of the worldwide aircraft fleet, the percentage of the fleet that is out-of-warranty and changes in the profitability of the commercial airline industry. RPKs and airline profitability have historically been correlated with the general economic environment, although national and international events also play a key role. For example, in addition to the COVID-19 pandemic and the adverse impact it had on the airline industry, past examples in which the airline industry has been negatively affected include downturns in the global economy, higher fuel prices, increased security concerns among airline customers following the events of September 11, 2001, the Severe Acute Respiratory Syndrome (also known as “SARS”) epidemic, and conflicts abroad. Future geopolitical or other worldwide events, such as war, terrorist acts, or additional worldwide infectious disease outbreaks could also impact our customers and our sales to them.

In addition, global market and economic conditions have been challenging due to turbulence in the U.S. and international markets and economies and have prolonged declines in business and consumer spending. As a result of the substantial reduction in airline traffic resulting from the aforementioned events, the airline industry incurred large losses and financial difficulties. Some carriers parked or retired a portion of their fleets and reduced workforces and flights. During periods of reduced airline profitability, some airlines may delay purchases of spare parts, preferring instead to deplete existing inventories, and delay refurbishments and discretionary spending. If demand for spare parts decreases, there would be a decrease in demand for certain products. An adverse change in demand would impact our results of operations, collection of accounts receivable and our expected cash flow generation from current and acquired businesses which may adversely impact our financial condition and access to capital markets.

Technology failures or cyber security breaches or other unauthorized access to our information technology systems or sensitive or proprietary information could have an adverse effect on the Company’s business and operations.

We rely on information technology systems to process, transmit, store, and protect electronic information. For example, a significant portion of the communications between our personnel, customers, suppliers and vendors depends on information technology and we rely on access to such information systems for our operations. Additionally, we rely on third-party service vendors to execute certain business processes and maintain certain information technology systems and infrastructure. The security measures in place may not prevent disruptions, failures, computer viruses or other malicious codes, malware or ransomware incidents, unauthorized access attempts, theft of intellectual property, trade secrets, or other corporate assets, denial of service attacks, phishing, hacking by common hackers, criminal groups or nation-state organizations or social activist (“hacktivist”) organizations, and other cyber-attacks or other privacy or security breaches in the information technology, phone systems or other systems (whether due to third-party action, bugs or vulnerabilities, physical break-ins, employee error, malfeasance or otherwise) of the Company, our customers or third parties, which could adversely affect our communications and business operations. Further, events such as natural disasters, fires, power outages, systems failures, telecommunications failures, employee error or malfeasance or other catastrophic events could similarly cause interruptions, disruptions or shutdowns, or exacerbate the risk of the failures described above. These risks may be increased as more employees work from home. We may not have the resources or technical sophistication to anticipate, prevent or detect rapidly evolving types of cyber-attacks and other security risks. Attacks may be targeted at us, our customers, suppliers or vendors, or others who have entrusted us with information. To date, the Company has not experienced any material impact to the business or operations resulting from information or cybersecurity attacks. However, because of the frequently changing attack techniques, along with the increased volume, persistence and sophistication of the attacks, the Company may be adversely impacted in the future. Because such

15

techniques change frequently or may be designed to remain dormant until a predetermined event and often are not recognized until launched against a target, we may be unable to anticipate these techniques or implement sufficient control measures to defend against these techniques. Once a security incident is identified, we may be unable to remediate or otherwise respond to such an incident in a timely manner. While the Company has policies and procedures in place, including system monitoring and data back-up processes to prevent or mitigate the effects of these potential disruptions or breaches, security breaches and other disruptions to information technology systems could interfere with our operations. Any failure to maintain, or disruption to, our information technology systems, whether as a result of cybersecurity attacks or otherwise, could damage our reputation, subject the Company to legal claims and proceedings or remedial actions, create risks of violations of data privacy laws and regulations, and cause us to incur substantial additional costs. Existing or emerging threats may have an adverse impact on our systems or communications networks and, further, technological enhancements to prevent business interruptions could require increased spending. Furthermore, security breaches pose a risk to confidential data and intellectual property, which could result in damage to our competitiveness and reputation. The costs, potential monetary damages, and operational consequences of responding to cyber incidents and implementing remediation measures may not be covered by any insurance that we may carry from time to time. We cannot predict the degree of any impact that increased monitoring, assessing, or reporting of cybersecurity matters would have on operations, financial conditions and results.

Additionally, in connection with our global operations, we, from time to time, transmit data across national borders to conduct our business and, consequently, are subject to a variety of laws and regulations regarding privacy, data protection, and data security, including those related to the collection, processing, storage, handling, use, disclosure, transfer, and security of personal data, including the European Union General Data Protection Regulation, Personal Information Protection Law in China and similar regulations in states within the United States and in countries around the world. Our efforts to comply with privacy and data protection laws may impose significant costs and challenges that are likely to increase over time.

From time to time, we may implement new technology systems or replace and/or upgrade our current information technology systems. These upgrades or replacements may not improve our productivity to the levels anticipated and may subject us to inherent costs and risks associated with implementing, replacing, and updating these systems, including potential disruption of our internal control structure, substantial capital expenditures, demands on management time and other risks of delays or difficulties in transitioning to new systems or of integrating new systems into other existing systems.

Technology failures or cyber security breaches or other unauthorized access to information technology systems of our customers, suppliers or vendors could have an adverse effect on the Company’s business and operations.

We rely on direct electronic interfaces with some of our key customers, suppliers and vendors. Cyber security breaches or technology failures at our customers could result in changes to timing and volume of orders. Additionally cyber security breaches or technology failures at our suppliers or vendors could impact the timing or availability of key materials that could negatively impact our ability to deliver products to our customers.

We could incur substantial costs as a result of data protection concerns.

The interpretation and application of data protection laws in the U.S. and Europe, including, but not limited to, the General Data Protection Regulation (the “GDPR”) and the California Consumer Privacy Act (the “CCPA”), and elsewhere are uncertain and evolving. It is possible that these laws may be interpreted and applied in a manner that is inconsistent with our data practices. Complying with these various laws is difficult and could cause us to incur substantial costs or require us to change our business practices in a manner adverse to our business. Further, although we have implemented internal controls and procedures designed to ensure compliance with the GDPR, CCPA and other privacy-related laws, rules and regulations (collectively, the “Data Protection Laws”), our controls and procedures may not enable us to be fully compliant with all Data Protection Laws.

Our inability to adequately enforce and protect our intellectual property or defend against assertions of infringement could prevent or restrict our ability to compete.