DEF 14A: Definitive proxy statements

Published on April 22, 2025

Filed by the Registrant X |

Filed by a Party other than the Registrant O |

| O | Preliminary Proxy Statement |

| O | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| X | Definitive Proxy Statement |

| O | Definitive Additional Materials |

| O | Soliciting Material under § 240.14a-12 |

| X | No fee required. |

| O | Fee paid previously with preliminary materials. |

| O | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

Notice of 2025 Annual Meeting of Shareholders and Proxy Statement www.loargroup.com ir@loaegroup.com NYSE: LOAR

April 22, 2025

Fellow stockholders:

Since founding the company in 2012, we have strived to build Loar into an industry-leading aerospace and defense component supplier. Our business approach, which couples strong organic growth with our proven acquisition strategy, has created one of the most unique companies in our industry, resulting in an historic year for our company, shareholders, and teammates. We are excited to welcome all the new owners of Loar and thank you for your trust and investment.

To our public investors (partners), on behalf of our Board of Directors and our teammates, we want to thank you for your confidence and investment in Loar Holdings Inc. (Loar). As you know, 2024 was a year of transformation for the company. We effected a successful initial public offering (IPO), closed the largest acquisition in Loar’s history (Applied Avionics), and recorded record financial performance, all while continuing to execute on our core value drivers. … Launching new products, Optimizing productivity, Achieving price above inflation and Readying talent. Our execution of these value drivers resulted in record sales and Adjusted EBITDA in 2024 - levels that we expect to continue to surpass as we move forward through the collective efforts of 1,500 of the best teammates in the world. We have just two words for our mates … THANK YOU.

With a successful 2024 behind us, we now look to the journey ahead. A journey that will be unique to Loar, supported by the foundation of our value drivers, culture, commitment to always having a curious mind, and an unrelenting growth mindset. We are therefore pleased to invite our Partners to join us at our inaugural annual meeting as a public company. The annual meeting will be a virtual stockholder meeting, conducted via live webcast at www.virtualshareholdermeeting.com/LOAR2025 on Tuesday, June 3, 2025 at 10 a.m., Eastern Time, at which you can submit questions and vote online.

We ask for your support on the voting items in our proxy to enable us to continue to execute on our focus of building world-class products for our customers and delivering strong financial results for our stockholders. Whether or not you plan to participate in the annual meeting, we strongly encourage you to vote as soon as possible to ensure that your shares are represented at the meeting. The accompanying Proxy Statement explains more about voting. Please read it carefully.

| Sincerely, |

||

|

|

|

|

| Dirkson Charles |

Brett Milgrim |

|

| President, Chief Executive Officer and Executive Co-Chairman |

Executive Co-Chairman |

|

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS To Be Held on June 3, 2025

Dear Stockholders:

We are pleased to invite you to attend the 2025 Annual Meeting of Stockholders (together with any adjournments, postponements, or continuations thereof, the “Annual Meeting”) of Loar Holdings Inc., a Delaware corporation. The Annual Meeting will be exclusively held virtually via live webcast at www.virtualshareholdermeeting.com/LOAR2025 on Tuesday, June 3, 2025 at 10 a.m., Eastern Time. The virtual format of the Annual Meeting allows us to preserve stockholder access while saving time and money for both us and our stockholders. With a virtual format you will be able to vote and submit questions during the Annual Meeting, and we encourage you to attend online and participate.

The Annual Meeting will take place to address the purposes outlined in the accompanying materials.

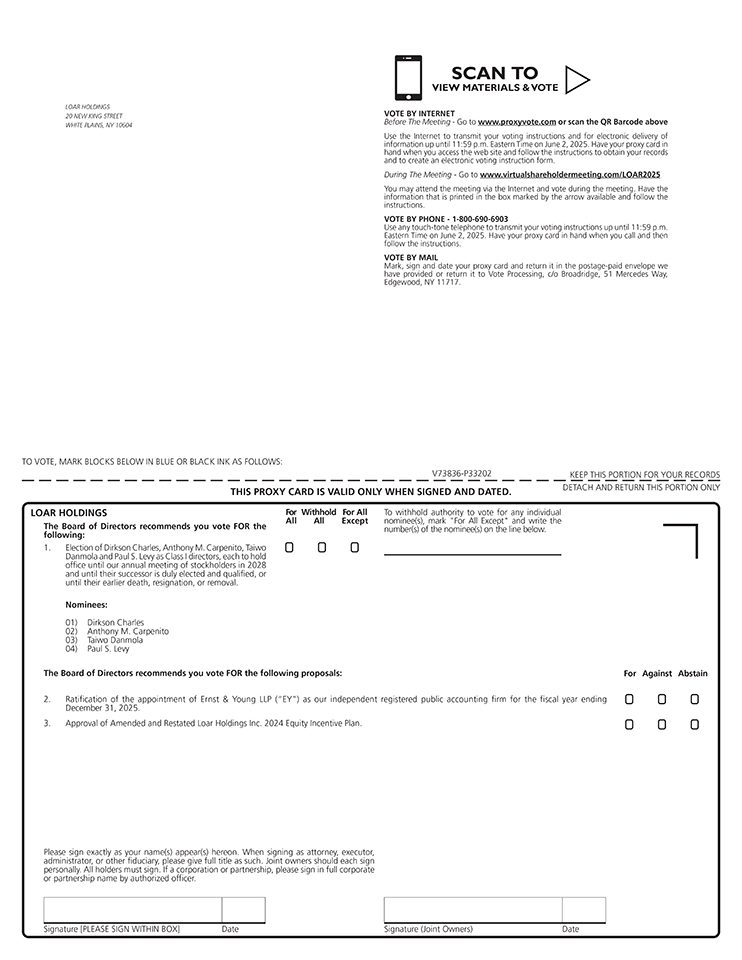

| 1. | To elect four nominees for Class I directors: Dirkson Charles, Anthony M. Carpenito, Taiwo Danmola and Paul S. Levy, each to hold office until our annual meeting of stockholders in 2028 and until their successor is duly elected and qualified, or until their earlier death, resignation, or removal; |

| 2. | To ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2025; |

| 3. | To amend the Loar Holdings Inc. 2024 Equity Incentive Plan; and |

| 4. | To conduct any other business properly brought before the Annual Meeting. |

A printed copy of our proxy materials, including a proxy card, the proxy statement for the Annual Meeting (the “Proxy Statement”) and our Annual Report on Form 10-K for the fiscal year ended December 31, 2024 (“2024 Annual Report”), is being mailed to our stockholders on or about April 22, 2025 and sent by e-mail to our stockholders who have opted for such means of delivery on or about April 22, 2025. The proxy materials provide instructions on how to vote online or by telephone. The Proxy Statement and our 2024 Annual Report can also be accessed directly at www.proxyvote.com using the control number located on your proxy card, or in the instructions that accompanied the proxy materials.

Our board of directors has fixed the close of business on April 21, 2025 as the record date for the Annual Meeting. Only holders of record of shares of our common stock as of the close of business on April 21, 2025 are entitled to notice of, and to vote at, the Annual Meeting.

| By Order of the Board of Directors, |

|

|

| Michael J. Manella |

| Vice President, General Counsel and Secretary, |

| White Plains, New York |

| April 22, 2025 |

Your vote is important. Whether or not you plan to virtually attend the Annual Meeting, please ensure that your shares are voted during the Annual Meeting by signing and returning a proxy card or by using our internet or telephonic voting system. Even if you have voted by proxy, you may still vote online if you attend the Annual Meeting. Please note, however, that if your shares are held on your behalf by a brokerage firm, bank, or other nominee, and you wish to vote at the Annual Meeting, you must obtain a proxy issued in your name from that nominee.

Table of Contents

Proxy Summary

| Annual Meeting Details |

||||

|

|

|

||

| Date & Time | Location | Record Date | ||

| Tuesday, June 3, 2025 10:00 a.m. Eastern time | Virtually via live webcast on the internet at www.virtualshareholdermeeting.com/LOAR2025 | April 21, 2025 | ||

Only shareholders of record as of the close of business on the record date are entitled to vote at the annual meeting. Proxy materials are first being sent or made available to shareholders on April 22, 2025.

| Proposals | Recommendation of the Board | Page # | ||||||

| 1 | Election of 4 director nominees to our board of directors |

|

FOR each nominee | 10 | ||||

| 2 | Ratification of the appointment of Ernst & Young as our independent registered public accounting firm for the fiscal year ending December 31, 2025 |

|

FOR | 22 | ||||

| 3 | Approval of Amended and Restated Loar Holdings Inc. 2024 Equity Incentive Plan |

|

FOR | 25 | ||||

Ways to Vote

For more detailed information, see the section entitled “How can I vote?” on page 7.

|

|

|

|

|||

| Online | By Phone | By Mail | During the Meeting | |||

| You may vote online prior to the annual meeting by visiting www.proxyvote.com | If you received a proxy card by mail, by dialing (via touch-tone telephone) the toll-free phone number on your proxy card under “Vote by Phone” and following the instructions | If you received printed copies of the proxy materials, you may vote by mail | You may vote during the Annual Meeting by following the instructions available on the meeting website | |||

Loar Holdings Inc.

20 New King Street

White Plains, New York 10604

Proxy Statements

for the 2025 Annual Meeting of Stockholders

To Be Held at 10 a.m., Eastern Time, on Tuesday, June 3, 2025

Our board of directors is soliciting your proxy to vote at the 2025 Annual Meeting of Stockholders (together with any adjournments, postponements, or continuations thereof, the “Annual Meeting”) of Loar Holdings Inc., a Delaware corporation, for the purposes set forth in this proxy statement for the Annual Meeting (this “Proxy Statement”). The Annual Meeting will be exclusively held virtually via live webcast on the internet on Tuesday, June 3, 2025 at 10 a.m., Eastern Time. Beginning on or about April 22, 2025, the Company mailed the Notice of Annual Meeting of Shareholders, our Proxy Statement and form proxy card for the Annual Meeting and our Annual Report on Form 10-K for the year ended December 31, 2024 (the “2024 Annual Report”) to all stockholders entitled to vote at the Annual Meeting. If you held shares of our common stock at the close of business on April 21, 2025 (the “Record Date”), you are invited to virtually attend the Annual Meeting at www.virtualshareholdermeeting.com/LOAR2025 and vote on the proposals described in this Proxy Statement.

In this Proxy Statement, we refer to Loar Holdings Inc. as “Loar,” “the Company,” “we,” “us,” or “our” and the board of directors of Loar as “our board of directors.” The 2024 Annual Report accompanies this Proxy Statement.

The information provided in the “question and answer” format below is for your convenience only and is merely a summary of the information contained elsewhere in this Proxy Statement.

You should read this entire Proxy Statement carefully. Information contained on, or that can be accessed through, our website is not intended to be incorporated by reference into this Proxy Statement and references to our website address in this Proxy Statement are inactive textual references only.

2

Questions and Answers About the Annual Meeting

What are proxy materials?

As a stockholder, you are invited to attend the Annual Meeting and are requested to vote on the items of business described in this Proxy Statement. A Proxy Statement is a document that includes information that we are required to provide to you under the rules of the U.S. Securities and Exchange Commission (the “SEC”) and is designed to assist you in voting your shares at the Annual Meeting. The proxy materials for the Annual Meeting include a proxy card, the Proxy Statement and the 2024 Annual Report. The accompanying proxy is delivered and solicited on behalf of the board of directors of Loar in connection with the Annual Meeting, which will be exclusively held virtually via live webcast on the internet at www.virtualshareholdermeeting.com/LOAR2025 on June 3, 2025 at 10 a.m., Eastern Time.

Will I receive proxy materials by mail?

Beginning on or about April 22, 2025, the Company mailed the Notice of Annual Meeting of Shareholders, our Proxy Statement and form proxy card for the Annual Meeting and the 2024 Annual Report. The Company’s Proxy Statement and 2024 Annual Report are available at www.proxyvote.com.

| What am I voting on? There are three matters scheduled for a vote at the Annual Meeting: |

||||

| Proposal 1 | Proposal 2 | Proposal 3 | ||

| Election of Dirkson Charles, Anthony M. Carpenito, Taiwo Danmola and Paul S. Levy as Class I directors, each to hold office until our annual meeting of stockholders in 2028 and until their successor is duly elected and qualified, or until their earlier death, resignation, or removal. |

Ratification of the appointment of Ernst & Young LLP (“EY”) as our independent registered public accounting firm for the fiscal year ending December 31, 2025. | Approval of Amended and Restated Loar Holdings Inc. 2024 Equity Incentive Plan. | ||

3

How does the board of directors recommend I vote on these proposals?

Our board of directors recommends a vote:

| ● | “FOR” the election of each of Dirkson Charles, Anthony M. Carpenito, Taiwo Danmola and Paul S. Levy as a Class I director; |

| ● | “FOR” the ratification of the appointment of EY as our independent registered public accounting firm for the fiscal year ending December 31, 2025; and |

| ● | “FOR” the approval of the Company’s Amended and Restated Loar Holdings Inc. 2024 Equity Incentive Plan. |

How many votes are needed for approval of each proposal?

The voting requirements for each proposal being voted on at the Annual Meeting, as well as the effect of votes withheld, abstentions, and broker non-votes, if any, are as follows:

| ● | Proposal One: Election of Class I directors requires a plurality of the votes properly cast for the applicable nominee to be elected. “Plurality” means that the nominees who receive the largest number of votes cast “FOR” are elected as directors. You may vote “For” or “Withhold” on each of the nominees on this proposal. Proposal One is considered to be a “non-routine” matter under the rules of the New York Stock Exchange (the “NYSE”), meaning that your brokerage firm, bank, or other nominee may not vote your shares on the proposal in the absence of your voting instructions, which would result in a “broker non-vote.” Shares voting “Withhold” and broker non-votes will have no effect on the outcome of the vote on this proposal. |

| ● | Proposal Two: Ratification of the appointment of EY as our independent registered public accounting firm for the fiscal year ending December 31, 2025 requires the affirmative vote of a majority of the votes properly cast on this proposal. You may vote “For,” “Against,” or “Abstain” on this proposal. Proposal Two is considered to be a “routine” matter under the rules of the NYSE. Accordingly, if you beneficially own your shares and do not provide voting instructions to your brokerage firm, bank, or other nominee by its deadline, your shares may be voted on Proposal Two by your brokerage firm, bank, or other nominee in its discretion. Abstentions and broker non-votes, if any, will have no effect on the outcome of the vote on this proposal. |

| ● | Proposal Three: Approval of the Company’s Amended and Restated Loar Holdings Inc. 2024 Equity Incentive Plan requires the affirmative vote of a majority of the votes properly cast on this proposal. You may vote “For,” “Against,” or “Abstain” on this proposal. Proposal Three is considered to be a “non-routine” matter under the rules of the NYSE, meaning that your brokerage firm, bank, or other nominee may not vote your shares on the proposal in the absence of your voting instructions, which would result in a “broker non-vote.” Shares voting “Withhold” and broker non-votes will have no effect on the outcome of the vote on this proposal. |

If I am a stockholder of record and I do not vote, or if I return a proxy card or otherwise vote without giving specific voting instructions, what happens?

If you are a stockholder of record and do not vote through the internet, by telephone, by completing a proxy card, or online during the Annual Meeting, your shares will not be voted. If you return a signed and dated proxy card or otherwise vote without marking voting selections, your shares will be voted in accordance with the recommendations of our board of directors:

| ● | “FOR” the election of each of Dirkson Charles, Anthony M. Carpenito, Taiwo Danmola and Paul S. Levy as a Class I director; |

| ● | “FOR” the ratification of the appointment of EY as our independent registered public accounting firm for the fiscal year ending December 31, 2025; and |

4

| ● | “FOR” the approval of the Company’s Amended and Restated Loar Holdings Inc. 2024 Equity Incentive Plan. |

If any other matter is properly presented at the Annual Meeting, your proxy holder (one of the individuals named on your proxy card) will vote your shares using his or her best judgment.

If I am a beneficial owner of shares held in an account with a brokerage firm, bank, or other nominee (or in “street name”) and I do not provide my brokerage firm, bank, or other nominee with voting instructions, what happens?

If you are a beneficial owner of shares held in an account with a brokerage firm, bank, or other nominee (or in “street name”) and do not instruct your brokerage firm, bank, or other nominee how to vote your shares, your brokerage firm, bank, or other nominee may still be able to vote your shares in its discretion. Under the rules of the NYSE, brokerage firms, banks, and other nominees that are subject to NYSE rules may use their discretion to vote your “uninstructed” shares on matters considered to be “routine” under NYSE rules, but not with respect to “non-routine” matters. A broker non-vote occurs when a brokerage firm, bank, or other nominee has not received voting instructions from the beneficial owner of the shares and the brokerage firm, bank, or other nominee cannot vote the shares because the matter is considered “non-routine” under NYSE rules. Proposal One and Proposal Three are considered to be “non-routine” under NYSE rules, meaning that your brokerage firm, bank, or other nominee may not vote your shares on the proposal in the absence of your voting instructions, which would result in a “broker non-vote.” Conversely, Proposal Two is considered to be “routine” under NYSE rules, meaning that if you do not return voting instructions to your brokerage firm, bank, or other nominee by its deadline, your shares may be voted on Proposal Two by your brokerage firm, bank, or other nominee in its discretion.

What are “broker non-votes”?

As discussed above, when a beneficial owner of shares held in “street name” does not give voting instructions to the brokerage firm, bank, or other nominee as to how to vote your shares on matters considered to be “non-routine” under NYSE rules, the brokerage firm, bank, or other nominee cannot vote the shares. These unvoted shares are counted as “broker non-votes.” Each of Proposal One and Proposal Three is a “non-routine” matter under NYSE rules and, therefore, broker non-votes may occur in connection with Proposal One or Proposal Three.

What is a quorum?

A quorum is the minimum number of shares or voting power required to be present at the Annual Meeting to properly hold an annual meeting of stockholders and conduct business under our amended and restated bylaws (our “Bylaws”) and Delaware law.

A quorum will be present if stockholders holding a majority of the voting power of the outstanding shares of our stock entitled to vote at the Annual Meeting are present at the Annual Meeting either by virtual attendance or by proxy. As of the Record Date, there were 93,556,071 shares of common stock outstanding and entitled to vote. Each share of common stock is entitled to one vote on each proposal.

Your shares will be counted as present only if you submit a valid proxy (or one is submitted on your behalf by your brokerage firm, bank, or other nominee) or if you vote online during the Annual Meeting. Votes withheld, abstentions, and broker non-votes will be counted as shares present for purposes of the quorum requirement. If there is no quorum, the chairperson of the Annual Meeting or holders of a majority of the voting power of the shares present at the Annual Meeting may adjourn or postpone the Annual Meeting to another date.

What if another matter is properly brought before the Annual Meeting?

Our board of directors does not intend to bring any other matters to be voted on at the Annual Meeting, and currently knows of no other matters that will be presented for consideration at the Annual Meeting. If any other matters are properly brought before the Annual Meeting, your proxy holder (one of the individuals named on your proxy card) will vote your shares using his or her best judgment.

5

How do I attend and ask questions during the Annual Meeting?

We will be hosting the Annual Meeting online via live webcast only. You can attend the Annual Meeting live online at www.virtualshareholdermeeting.com/LOAR2025 by logging in with your control number. The meeting will start at 10 a.m., Eastern Time, on Tuesday, June 3, 2025. We recommend that you log in a few minutes before 10 a.m., Eastern Time, to ensure you are present when the Annual Meeting starts. The webcast will open 15 minutes before the start of the Annual Meeting.

|

In order to enter the Annual Meeting live webcast, you will need your control number, which is located on your proxy card if you are a stockholder of record. If you are the beneficial owner of your shares, your control number is included with your voting instruction card and voting instructions received from your brokerage firm, bank, or other nominee. Instructions on how to attend and participate are available at www.virtualshareholdermeeting.com/LOAR2025.

If you would like to submit a question during the Annual Meeting, you may log in at www.virtualshareholdermeeting.com/LOAR2025 using your control number, type your question into the “Ask a Question” field, and click “Submit.” When you log into the Annual Meeting, please review our rules of conduct, which have been prepared to ensure a productive and efficient meeting that is fair to all stockholders in attendance. We will answer as many questions as possible in the time allotted for the Annual Meeting. We will only answer questions that are submitted in accordance with the rules of conduct and are relevant to an agenda item to be |

|

| voted on by stockholders at the Annual Meeting, subject to time constraints. | ||

What if I have technical difficulties or trouble accessing the Annual Meeting?

We will have technicians available to assist you with any technical difficulties you may have accessing the virtual Annual Meeting. If you encounter any difficulties accessing the Annual Meeting during the check-in or meeting time, please call the technical support number that is available online at www.virtualshareholdermeeting.com/LOAR2025.

Why are you holding a virtual meeting?

We are excited to embrace the latest technology to provide ease of access, real-time communication, and cost savings for our stockholders and our company. Hosting a virtual meeting provides easy access for our stockholders and facilitates participation because stockholders can participate from any location around the world. We have structured our virtual meeting to provide stockholders the same rights as if the meeting were held in person, including the ability to vote shares electronically during the meeting and ask questions in accordance with the rules of conduct for the meeting.

Who can vote at the Annual Meeting?

Only stockholders of record at the close of business on the Record Date will be entitled to vote at the Annual Meeting. As of the Record Date, there were 93,556,071 shares of common stock outstanding and entitled to vote.

Stockholder of Record: Shares Registered in Your Name

If, at the close of business on the Record Date, your shares were registered directly in your name with our transfer agent, Equiniti Trust Company, LLC, then you are a stockholder of record. As a stockholder of record, you may vote online during the Annual Meeting or by proxy in advance. Whether or not you plan to attend the Annual Meeting, we urge you to vote your shares by proxy in advance of the Annual Meeting through the internet, by telephone, or by completing and returning a printed proxy card.

6

Beneficial Owner: Shares Held on Your Behalf by a Brokerage Firm, Bank, or Other Nominee

If, at the close of business on the Record Date, your shares were not held in your name, but on your behalf by a brokerage firm, bank, or other nominee, then you are the beneficial owner of shares held in “street name,” and the proxy materials are being forwarded to you by that nominee. Those shares will be reported as being held by the nominee (e.g., your brokerage firm) in the system of record used for identifying stockholders. As a beneficial owner of the shares, you are invited to attend the Annual Meeting, and you have the right to direct your brokerage firm, bank, or other nominee how to vote the shares in your account. Please refer to the voting instructions provided by your brokerage firm, bank, or other nominee. Many brokerage firms, banks, and other nominees enable beneficial owners to give voting instructions by telephone or over the internet as well as in writing. You are also welcome to attend the Annual Meeting and vote online during the meeting. However, because you are not the stockholder of record, you may not vote your shares at the Annual Meeting unless you request and obtain a valid proxy (sometimes referred to as a “legal proxy”) from your brokerage firm, bank, or other nominee. Follow the instructions from your brokerage firm, bank, or other nominee included with the proxy materials, or contact your nominee to request a proxy form. You may access the meeting and vote by logging in with your control number at www.virtualshareholdermeeting.com/LOAR2025.

How many votes do I have?

Each holder of shares of our common stock will have one vote per share of common stock held as of the Record Date. The holders of the shares of our common stock will vote as a single class on all matters described in this Proxy Statement for which your vote is being solicited.

How can I vote?

Your voting options depend on how you hold your shares.

Stockholder of Record: Shares Registered in Your Name

If you are a stockholder of record, you may vote (i) online during the Annual Meeting or (ii) in advance of the Annual Meeting by proxy through the internet, by telephone, or by using a proxy card that you may request or that we may elect to deliver at a later time. Whether or not you plan to attend the Annual Meeting, we urge you to vote by proxy to ensure your vote is counted. Even if you have submitted a proxy before the meeting, you may still attend online and vote during the meeting. In such case, your previously submitted proxy will be disregarded. For more information, see the question below titled “Can I change my vote or revoke my proxy after submitting a proxy?”

| ● | To vote online in advance of the Annual Meeting, go to www.proxyvote.com to complete an electronic proxy card. Votes through the internet must be received by 11:59 p.m., Eastern Time, on June 2, 2025 to be counted. |

| ● | To vote by telephone in advance of the Annual Meeting, call 1-800-690-6903 and follow the recorded instructions, including providing the control number located on your proxy card, or in the instructions that accompanied the proxy materials. Votes by telephone must be received by 11:59 p.m., Eastern Time, on June 2, 2025 to be counted. |

| ● | To vote using a printed proxy card in advance of the Annual Meeting, complete, sign, and date a printed proxy card and return it promptly in the envelope provided. If we receive your signed proxy card by 11:59 p.m., Eastern Time, on June 2, 2025, we will vote your shares as directed. |

| ● | To vote online during the Annual Meeting, follow the provided instructions to join the Annual Meeting at www.virtualshareholdermeeting.com/LOAR2025, starting at 10 a.m., Eastern Time, on Tuesday, June 3, 2025. You will need to enter the control number located on your proxy card, or in the instructions that accompanied the proxy materials. The webcast will open 15 minutes before the start of the Annual Meeting. |

7

Beneficial Owner: Shares Held on Your Behalf by a Brokerage Firm, Bank, or Other Nominee

If you are a beneficial owner of shares held on your behalf by a brokerage firm, bank, or other nominee, you should have received a proxy card containing voting instructions from that nominee rather than from us. To vote online during the Annual Meeting, you must follow the instructions from such nominee.

What is the effect of giving a proxy?

Proxies are solicited by and on behalf of our board of directors. The persons named in the proxy have been designated as proxy holders by our board of directors. When a proxy is properly dated, executed, and returned, the shares represented by such proxy will be voted at the Annual Meeting in accordance with the instructions of the stockholder. If no specific instructions are given, however, the shares will be voted in accordance with the recommendations of our board of directors.

If any matters not described in this Proxy Statement are properly presented at the Annual Meeting, the proxy holders will use their own judgment to determine how to vote the shares. If the Annual Meeting is postponed or adjourned, the proxy holders can vote the shares on the new Annual Meeting date as well, unless you have properly revoked your proxy, as described in the question below titled “Can I change my vote or revoke my proxy after submitting a proxy?”

Can I change my vote or revoke my proxy after submitting a proxy?

Yes. If you are a stockholder of record, you can change your vote or revoke your proxy at any time before the final vote at the Annual Meeting in any one of the following ways:

| ● | Submit another properly completed proxy card with a later date; |

| ● | Grant a subsequent proxy by telephone or through the internet; |

| ● | Send a timely written notice that you are revoking your proxy to our Secretary via email at secretary@loargroup.com; or |

| ● | Attend the Annual Meeting and vote online during the meeting. Attending the Annual Meeting will not, by itself, change your vote or revoke your proxy. Even if you plan to attend the Annual Meeting, we recommend that you also submit your proxy or voting instructions or vote in advance of the Annual Meeting by telephone or through the internet so that your vote will be counted if you later decide not to attend the Annual Meeting. |

If you are a beneficial owner and your shares are held in “street name” on your behalf by a brokerage firm, bank, or other nominee, you should follow the instructions provided by that nominee.

How can I find out the results of the voting at the Annual Meeting?

We expect that preliminary voting results will be announced at the Annual Meeting. In addition, final voting results will be published in a Current Report on Form 8-K that we expect to file with the SEC within four business days after the Annual Meeting. If final voting results are not available to us in time to file a Current Report on Form 8-K within four business days after the Annual Meeting, we intend to file a Current Report on Form 8-K with the SEC to publish the preliminary results within four business days after the Annual Meeting and, within four business days after the final results are known to us, file an amendment to the Current Report on Form 8-K with the SEC to publish the final results.

Who is paying for this proxy solicitation?

We are paying for the cost of soliciting proxies. In addition to these proxy materials, our directors and employees may also solicit proxies in person, by telephone, or by other means of communication. Directors and employees will not be paid any additional compensation for soliciting proxies. We may also reimburse brokerage firms, banks,

8

and other nominees for the cost of forwarding proxy materials to beneficial owners. If you choose to access the proxy materials and/or vote over the internet, you are responsible for any internet access charges you may incur.

When are stockholder proposals and director nominations due for next year’s annual meeting?

Requirements for stockholder proposals to be considered for inclusion in the proxy materials

To be considered for inclusion in next year’s proxy materials, stockholder proposals submitted pursuant to Rule 14a-8 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), must be submitted in writing by December 22, 2025, to our Secretary at Loar Holdings Inc., 20 New King Street, White Plains, New York 10604, Attention: Secretary.

Requirements for stockholder proposals to be brought before the annual meeting

Our Bylaws provide that, for stockholder proposals not included in next year’s proxy materials to be considered at an annual meeting, stockholders must provide timely advance written notice thereof to our Secretary at Loar Holdings Inc., 20 New King Street, White Plains, New York 10604, Attention: Secretary. In order to be considered timely, notice of a proposal (including a director nomination) for consideration at the 2026 annual meeting of stockholders must be received by our Secretary in writing not later than the close of business on March 5, 2026 nor earlier than the close of business on February 3, 2026. However, if our 2026 annual meeting of stockholders is not held between May 4, 2026 and July 31, 2026, the notice must be received not later than the close of business on the later of (A) the 90th day prior to the 2026 annual meeting of stockholders and (B) the 10th day following the day on which public announcement of the date of the 2026 annual meeting is first made. Any such notice to the Secretary must include the information required by our Bylaws.

To comply with the universal proxy rules, stockholders who intend to solicit proxies in support of director nominees other than our nominees must satisfy the foregoing requirements under our Bylaws and provide notice that sets forth the information required by Rule 14a-19 under the Exchange Act by no later than the close of business on April 10, 2026.

9

PROPOSAL ONE: Elections of Directors

Number of Directors; Board Structure

Our board of directors consists of ten directors. Our board of directors is divided into three classes with staggered three-year terms. Only one class of directors will be elected at each annual meeting of stockholders, with the other classes continuing for the remainder of their respective three-year terms.

Our directors are divided into the three classes as follows:

| ● | the Class I directors are Dirkson Charles, Anthony M. Carpenito, Taiwo Danmola and Paul S. Levy, whose terms will expire at the Annual Meeting; |

| ● | the Class II directors are Raja Bobbili, Alison Bomberg and Margaret (Peg) McGetrick, whose terms will expire at the annual meeting of stockholders to be held in 2026; and |

| ● | the Class III directors are Brett Milgrim, David Abrams and M. Chad Crow, whose terms will expire at the annual meeting of stockholders to be held in 2027. |

Each director’s term will continue until the election and qualification of their successor, or their earlier death, resignation or removal.

Nominees

At the recommendation of our nominating and corporate governance committee, our board of directors has nominated Dirkson Charles, Anthony M. Carpenito, Taiwo Danmola and Paul S. Levy for re-election as Class I directors at the Annual Meeting. If re-elected, each of Mr. Charles, Mr. Carpenito, Mr. Danmola and Mr. Levy will serve as a Class I director until the annual meeting of stockholders to be held in 2028 and until their successor is elected and qualified, or until their earlier death, resignation or removal. Each of the nominees is a current Class I director and member of our board of directors. For information concerning the nominees, see the section titled “Information Regarding Director Nominees and Current Directors.”

Unless you direct otherwise through your proxy voting instructions, the persons named as proxies will vote all proxies received “FOR” the election of each nominee named above. If any nominee is unable or unwilling to serve as a director at the time of the Annual meeting, the persons named as proxies may vote for a substitute nominee proposed by our board of directors. Alternatively, the proxies may vote only for the remaining nominees, leaving a vacancy on our board of directors. Our board of directors may fill a vacancy at a later date or reduce the size of our board of directors. Our management has no reason to believe that any of the nominees will be unwilling or unable to serve if re-elected as a director.

Vote Required

Directors are elected by a plurality of the votes properly cast at the Annual Meeting. Accordingly, the three nominees receiving the highest number of “FOR” votes will be elected. If nominees are unopposed, election requires only a single “FOR” vote or more. Any shares voting “WITHHOLD” will have no effect on the outcome of the election of the nominees. Broker non-votes are not considered votes cast for the foregoing purpose and will have no effect on the election of the nominees.

OUR BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE ELECTION OF EACH OF DIRKSON CHARLES, ANTHONY M. CARPENITO, TAIWO DANMOLA AND PAUL S. LEVY AS A CLASS I DIRECTOR.

10

Information Regarding Director Nominees and Current Directors

The following table sets forth, for the Class I director nominees for election at the Annual Meeting and our other directors who will continue in office after the Annual Meeting, their ages, independence, and position or office held with us as of April 21, 2025:

| Name |

Age | Independent | Position | |||

| Class I director nominees for election at the Annual Meeting |

||||||

| Dirkson Charles |

61 | President, Chief Executive Officer, Executive Co-Chairman and Director | ||||

| Anthony M. Carpenito(1) |

50 | X | Director | |||

| Taiwo Danmola(2) |

65 | X | Director | |||

| Paul S. Levy(1)(3) |

77 | X | Director | |||

| Class II directors continuing in office until the annual meeting of stockholders to be held in 2026 |

||||||

| Raja Bobbili(3) |

37 | X | Director | |||

| Alison Bomberg(1) |

56 | X | Director | |||

| Margaret (Peg) McGetrick(2) |

66 | X | Director | |||

| Class III directors continuing in office until the annual meeting of stockholders to be held in 2027 |

||||||

| Brett Milgrim |

56 | Executive Co-Chairman and Director | ||||

| David Abrams(3)* |

64 | X | Director | |||

| M. Chad Crow(2) |

57 | X | Director | |||

* Lead independent director.

(1) Member of the nominating and corporate governance committee.

(2) Member of the audit committee.

(3) Member of the compensation committee.

11

Nominees for Election at the Annual Meeting

Dirkson Charles founded Loar Group Inc. in 2012 and has served as President, Chief Executive Officer and Executive Co-Chairman since inception. He has served as President, Chief Executive Officer and Executive Co-Chairman of Loar Holdings Inc., formerly known as Loar Holdings, LLC, since its inception in 2017. He also served as Executive Manager and Co-Chairman of the Board of Managers of Loar Acquisition 13, LLC, a Delaware limited liability company (“LA 13”), from its inception in 2017 until its liquidation following our initial public offering. He joined our board of directors in connection with our initial public offering. From May 2007 to December 2010, Mr. Charles served as an Executive Vice President of McKechnie Aerospace responsible for all aspects of financial operations for this multinational organization. From February 1989 to May 2007, Mr. Charles was Executive Vice President and Chief Financial Officer with K&F Industries, a leading manufacturer of aviation wheels, brakes, fuel tanks and brake control systems. In addition, Mr. Charles was with Arthur Andersen and Company for five years where he supervised audit engagements and acquired expertise in the Securities and Exchange Commission rules and regulations. Mr. Charles currently serves as the Chairman of Doncasters Group Limited, a position he has held since March of 2020. Mr. Charles has also served as a Director of Builders FirstSource, Inc. since June 2022. Mr. Charles holds an undergraduate degree in public accounting and an M.B.A. in finance from Pace University. He is a certified public accountant in the State of New York.

Mr. Charles is the President, Chief Executive Officer and Executive Co-Chairman of Loar Holdings Inc., formerly known as Loar Holdings, LLC. That role, along with his service as a member of the board of directors of a public company, prior high-level leadership positions and his critical accounting skills as a licensed C.P.A. and from his prior experience in public accounting, make him an essential Board member.

Anthony M. Carpenito served as Manager on the Board of Managers of LA 13 from 2019 until its liquidation following our initial public offering. He joined our board of directors in connection with our initial public offering. Since April 2015, Mr. Carpenito has served at Abrams Capital Management, LLC, where he is currently Head of Private Capital Markets. Previously, Mr. Carpenito spent nearly 10 years in Credit Suisse’s Private Fund Group, including as Managing Director and Head of the Real Estate Private Fund Group. Prior to that role, he spent three years at GAMCO Investors in a hedge fund capital raising role. He started his career at Goldman Sachs, holding various roles in Controllers, emerging debt capital markets and asset management. Mr. Carpenito holds a B.A. in Economics and Political Science from Bucknell University and an M.B.A. from Columbia University.

Mr. Carpenito has extensive experience in private equity investing, financial matters, and knowledge and understanding of business and corporate strategy, including from his long tenure on the Board of Managers of LA 13.

Taiwo Danmola served as Manager on the Board of Managers of LA 13 from February 2024 until its liquidation following our initial public offering. He joined our board of directors in connection with our initial public offering. Mr. Danmola has served as the Managing Member of Taiwo Danmola LLC since January 2021. He has also served as the part-time Chief Accounting Officer of Global Infrastructure Solutions Inc. since 2021. Mr. Danmola has also served as Director of Security Mutual Life Insurance Company of New York since September 2022. Prior to his current positions, Mr. Danmola served as Assurance Partner at Ernst & Young, LLP from 2002 to 2020. Previously, Mr. Danmola served as Assurance Partner at Arthur Andersen, LLP. Since 2022, Mr. Danmola served as a non-Trustee member of the Audit Committee of the Brooklyn Public Library and was appointed, effective April 2023, to its Board of Trustees. Mr. Danmola holds a B.S. in Accounting and a Minor in Economics from St. John’s University. Mr. Danmola is a Certified Public Accountant in New York State.

Mr. Danmola has vast experience in accounting and auditing. Through his previous experience as an Assurance Partner at large auditing firms, he brings valuable knowledge to the Board and the Audit Committee.

Paul S. Levy served as Manager on the Board of Managers of LA 13 from its inception in 2017 until its liquidation following our initial public offering. He joined our board of directors in connection with our initial public offering.

12

Mr. Levy founded JLL Partners, a New York-based private equity firm, in 1988 and currently serves as its Managing Director. In addition, Mr. Levy is the Chairman of the Board of Directors of Builders FirstSource, Inc. Mr. Levy has also previously served on the boards of numerous private companies. In the last five years, Mr. Levy previously served on the boards of the following public companies: Patheon, Inc. and PGT Innovations, Inc. Mr. Levy holds a B.A. in History from Lehigh University and a J.D. from University of Pennsylvania.

Mr. Levy has vast experience investing in and managing a wide variety of businesses, including his long tenure on the Board of Managers of LA 13, and has served on the boards of directors of several public companies. Mr. Levy has also been a senior manager of a large company, general counsel of another company, and a practicing lawyer, bringing further breadth to his contributions to the Board.

Directors Continuing in Office Until the Annual Meeting of Stockholders to Be Held in 2026

Raja Bobbili served as Manager on the Board of Managers of LA 13 from its inception in 2017 until its liquidation following our initial public offering. He joined our board of directors in connection with our initial public offering. Since January 2014, Mr. Bobbili has served at Abrams Capital Management, LLC, where he is currently an Investment Analyst and Managing Director. Mr. Bobbili holds a B.S. in Electrical Engineering and Computer Science and a B.S. in Economics from the Massachusetts Institute of Technology, an M.B.A. from Harvard Business School and a J.D. from Harvard Law School.

Mr. Bobbili has extensive experience in private equity investing, financial matters, and knowledge and understanding of business and corporate strategy, including from his long tenure on the Board of Managers of LA 13.

Alison Bomberg served as Manager on the Board of Managers of LA 13 from its inception in 2017 until its liquidation following our initial public offering. She joined our board of directors in connection with our initial public offering. Since June 2015, Mrs. Bomberg has served at Abrams Capital Management, LLC, where she is currently a Managing Director and General Counsel. Previously, Mrs. Bomberg was a Partner in the Private Equity group of Ropes and Gray, LLP where she practiced law for 21 years. Mrs. Bomberg serves on the Advisory Board of the non-profit Boston Youth Symphony Orchestras. Mrs. Bomberg holds a B.A. in Foreign Policy from the University of Wisconsin-Madison and a J.D. from Boston University School of Law.

Ms. Bomberg has vast experience from her long tenure on the Board of Managers of LA 13. She serves as a senior lawyer of a large investment company. As a practicing lawyer, she brings valuable knowledge to the Board.

Margaret (Peg) McGetrick served as Manager on the Board of Managers of LA 13 from February 2024 until its liquidation following our initial public offering. She joined our board of directors in connection with our initial public offering. Ms. McGetrick has served as Director of Grantham, Mayo, Van Otterloo & Co. (“GMO”), an investment management company, since 2011. From 2016 to 2017, Ms. McGetrick served as the interim Chief Executive Officer of GMO when she stepped in from her Trustee position to manage a $70 billion global asset management firm through a corporate restructure and the hiring and onboarding of a new Chief Executive Officer. Previously, Ms. McGetrick was a Founding Partner and Portfolio Manager of Liberty Square Asset Management, a majority women-owned, multi-billion dollar hedge fund. Prior to that role, Ms. McGetrick served as Partner and Head of International Active at GMO. Ms. McGetrick has also served as Trustee of non-profit Save the Children US since 2017 and Trustee of Save the Children Association/Save the Children International Board since 2020. Ms. McGetrick holds a B.A. in Psychology and a B.S. in Business Management from Providence College, and an M.S. in Finance from Fairfield University.

Ms. McGetrick has extensive experience in investing, financial matters, and knowledge and understanding of business and corporate strategy, including from her long tenure at GMO. She will bring valuable knowledge to the Board and the Audit Committee.

13

Directors Continuing in Office Until the Annual Meeting of Stockholders to Be Held in 2027

Brett Milgrim has been the Executive Co-Chairman of Loar Holdings Inc., formerly known as Loar Holdings, LLC since 2017. He also served as Executive Manager and Co-Chairman of the Board of Managers of LA 13 from its inception in 2017 until its liquidation following our initial public offering. He joined our board of directors in connection with our initial public offering. From 1997 until his retirement in 2011, Mr. Milgrim was a Managing Director and Partner of JLL Partners, a New York-based private equity firm, where he was responsible for leading investments in JLL’s industrial vertical and has extensive experience in all areas of corporate finance and capital markets. His background involving the management of numerous aerospace and industrial companies is valuable in leading Loar’s overall corporate and acquisition strategies. Mr. Milgrim previously served in the Investment Banking department of Donaldson, Lufkin & Jenrette Securities Corporation. Mr. Milgrim currently serves on the Board of Directors of Builders FirstSource, Inc., a position he has held since 1999. Mr. Milgrim previously served as a director of Horizon Global Corporation until its acquisition in February 2023 and PGT Innovations, Inc. until its acquisition in March 2024. Mr. Milgrim holds an M.B.A. from The Wharton School of the University of Pennsylvania and a Bachelor’s Degree from Emory University.

Mr. Milgrim is the Executive Co-Chairman of Loar Holdings Inc., formerly known as Loar Holdings, LLC. That role, along with his knowledge regarding all aspects of corporate finance and capital markets and service on the boards of other public companies, make him an essential Board member.

David Abrams served as Manager on the Board of Managers of LA 13 from its inception in 2017 until its liquidation following our initial public offering. He joined our board of directors in connection with our initial public offering. Mr. Abrams founded Abrams Capital Management, LLC in 1999 and has been its Chief Executive Officer and Portfolio Manager since inception. Previously, Mr. Abrams was a senior investment professional with The Baupost Group of Boston, Massachusetts, for 10 years. Mr. Abrams holds a B.A. in History from the University of Pennsylvania.

Mr. Abrams has vast experience investing in a wide variety of businesses, including his long tenure on the Board of Managers of LA 13. He brings valuable knowledge to the Board.

M. Chad Crow served as Manager on the Board of Managers of LA 13 from February 2024 until its liquidation following our initial public offering. He joined our board of directors in connection with our initial public offering. Mr. Crow has served since April 2021 as a fractional Chief Financial Officer for Lone Star Pharmaceuticals, a pharmaceutical distribution company, and MAC Realty, a rental properties company. Previously, Mr. Crow joined Builders FirstSource, Inc. in September 1999, and held several roles of increasing responsibility thereafter. In 2009, Mr. Crow was named Senior Vice President and Chief Financial Officer; in 2014, he was promoted to President and Chief Operating Officer; and in 2017, he became a Director, President and Chief Executive Officer, serving in such roles until April 2021. Previously, he served in a variety of positions at Pier One Imports and Price Waterhouse LLP. Mr. Crow holds a B.B.A. in Accounting from Texas Tech University.

Mr. Crow has significant public company financial and executive experience. He has over 20 years of experience in senior and executive management and held a C.P.A. license for over 25 years. Through his previous experience as Chief Financial Officer and Chief Executive Officer of a publicly-traded company, Mr. Crow brings valuable knowledge to the Board and the Audit Committee.

14

Information Regarding the Board of Directors and Corporate Governance

Committees of Our Board of Directors

The standing committees of our Board consist of an Audit Committee, a Compensation Committee and a Nominating and Governance Committee. Our Board may also establish from time to time any other committees that it deems necessary or desirable.

The board of directors has extensive involvement in the oversight of risk management related to us and our business. Our chief executive officer and other executive officers will regularly report to the non-executive directors and the Audit Committee, the Compensation Committee and the Nominating and Governance Committee to ensure effective and efficient oversight of our activities and to assist in proper risk management and the ongoing evaluation of management controls. We believe that the leadership structure of our Board provides appropriate risk oversight of our activities.

Audit Committee

We have an Audit Committee, consisting of Taiwo K. Danmola, who serves as the chair, M. Chad Crow and Margaret (Peg) McGetrick, each of whom qualifies as an independent director under the corporate governance standards of the NYSE and the independence requirements of Rule 10A-3 of the Exchange Act. Our Board has determined that each of Mr. Danmola, Mr. Crow and Ms. McGetrick qualifies as an “audit committee financial expert” as such term is defined in Item 407(d)(5) of Regulation S-K. The purpose of the Audit Committee is to prepare the audit committee report required by the SEC to be included in our proxy statement and to assist our Board in overseeing:

| ● | accounting, financial reporting, and disclosure processes; |

| ● | adequacy and soundness of systems of disclosure and internal control established by management; |

| ● | the quality and integrity of our financial statements and related notes thereto and the annual independent audit of our financial statements; |

| ● | our independent registered public accounting firm’s qualifications and independence; |

| ● | the performance of our internal audit function and independent registered public accounting firm; |

| ● | our compliance with legal and regulatory requirements in connection with the foregoing; |

| ● | compliance with our Code of Conduct; |

| ● | overall risk management profile; and |

| ● | preparing the audit committee report required to be included in our proxy statement under the rules and regulations of the SEC. |

Our Board has adopted a written charter for the Audit Committee, which is available on our website.

15

● |

the establishment, maintenance and administration of compensation and benefit policies designed to attract, motivate and retain personnel with the requisite skills and abilities to contribute to our long term success; |

● |

setting our compensation program and compensation of our executive officers, directors and key personnel; |

● |

monitoring our incentive compensation and equity-based compensation plans; |

● |

succession planning for our executive officers, directors, and key personnel; |

● |

our compliance with the compensation rules, regulations, and guidelines promulgated by NYSE, the SEC and other law, as applicable; and |

● |

preparing the compensation committee report required to be included in our proxy statement under the rules and regulations of the SEC. |

● |

advise our Board concerning the appropriate composition of our Board and its committees; |

● |

identify individuals qualified to become members of our Board; |

● |

recommend to our Board the persons to be nominated by our Board for election as directors at any meeting of stockholders; |

● |

recommend to our Board the members of our Board to serve on the various committees of our Board; |

● |

develop and recommend to our Board a set of corporate governance guidelines and assist our Board in complying with them; and |

● |

oversee the evaluation of our Board, our Board committees, and management. |

Director Compensation

Each of our non-employee directors is eligible to receive compensation for his or her service on our Board consisting of annual cash retainers of $100,000, payable quarterly. Mr. Abrams, Mr. Bobbili, Mrs. Bomberg, Mr. Carpenito and Mr. Levy have waived and intend to waive any such cash retainers payable to them.

In connection with our initial public offering, we offered first time non-employee directors the opportunity to make a one-time election to participate in a stock purchase and matching grant program, which provides that if the non-employee director purchased shares of our common stock (the “Purchased Shares”) (the date of the first such purchase, the “Purchase Date”) as part of the directed share program in our initial public offering or, with respect to an individual who becomes a non-employee director after the closing of our initial public offering, at fair value within 30 days following the date the individual becomes a non-employee director, then the company issued pursuant to the 2024 Plan a matching grant of fully vested shares of our common stock (the “Matching Grant Shares”) equal to 25% of the aggregate fair value of the purchased shares, up to a maximum aggregate matching grant of $500,000 per director. For any non-employee director who elected to participate in this program, the Matching Grant Shares are restricted from sale pursuant to the terms of the 2024 Plan as follows: all Matching Grant Shares are restricted from sale prior to the third anniversary of such non-employee director’s Purchase Date, provided that such non-employee director may sell up to 50% of his or her Purchased Shares beginning the day after the first anniversary of his or her Purchase Date and ending on the third anniversary of his or her Purchase Date, after which all such restrictions will cease.

On April 24, 2024, we granted 17,857 Matching Grant Shares to each of Mr. Crow, Mr. Danmola and Ms. McGetrick, each of whom is a non-employee director of the Company who purchased shares of common stock under the directed share program of our initial public offering.

Our directors are reimbursed for travel, food, lodging and other expenses directly related to their activities as directors. Our directors are also entitled to the protection provided by the indemnification provisions in our bylaws. Our Board may revise the compensation arrangements for our directors from time to time.

Director Compensation Table

The following table sets forth information regarding compensation awarded to, earned by, or paid to each person who served as a non-employee member of our board of directors during the fiscal year ended December 31, 2024. Other than as set forth in the table and described more fully below, we did not pay any cash compensation, make any equity awards or non-equity awards, or pay any other compensation to any of the non-employee members of our board of directors in 2024 for their services as members of our board of directors. During the fiscal year ended December 31, 2024, Dirkson Charles, our President, Chief Executive Officer and Executive Co-Chairman, and Brett Milgrim, our Executive Co-Chairman, both served as members of our board of directors as well as employees. Mr. Charles and Mr. Milgrim did not receive any additional compensation for their services as members of our board of directors and therefore are not included in the table below. The total compensation earned by or paid to Mr. Charles and Mr. Milgrim is presented in the “Summary Compensation Table” in the section titled “Executive Compensation.”

20

| Name | Fee Earned or Paid in Cash ($)(1) | Stock Awards ($)(2) | Total ($) |

|||

| David Abrams(3) |

N/A | None | None | |||

| Raja Bobbili(3) |

N/A | None | None | |||

| Alison Bomberg(3) |

N/A | None | None | |||

| Anthony M. Carpenito(3) |

N/A | None | None | |||

| M. Chad Crow |

$100,000 | $500,000 | $600,000 | |||

| Taiwo Danmola |

$100,000 | $500,000 | $600,000 | |||

| Paul S. Levy(3) |

N/A | None | None | |||

| Margaret McGetrick |

$100,000 | $500,000 | $600,000 | |||

(1) Our non-employee directors became eligible to receive cash retainer payments effective as of the effective time of the registration statement for our IPO on April 24, 2024.

(2) The following table presents the aggregate number of stock awards held by our non-employee directors as of December 31, 2024.

| Name | Number of Stock Awards Held as of December 31, 2024 | |

| David Abrams(3) |

None | |

| Raja Bobbili(3) |

None | |

| Alison Bomberg(3) |

None | |

| Anthony M. Carpenito(3) |

None | |

| M. Chad Crow |

17,857 | |

| Taiwo Danmola |

17,857 | |

| Paul S. Levy(3) |

None | |

| Margaret McGetrick |

17,857 | |

(3) Elected to waive right to receive any non-employee director cash compensation.

21

PROPOSAL TWO

Ratification of Appointment of Independent

Registered Public Accounting Firm

Our audit committee has appointed Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2025. Our board of directors is submitting the appointment of EY to our stockholders for ratification at the Annual Meeting. EY has served as our independent registered public accounting firm since 2013.

Although ratification of the appointment of EY by our stockholders is not required by our Bylaws or otherwise, our board of directors is submitting the appointment of EY to our stockholders for ratification as a matter of good corporate governance. In the event that the appointment of EY is not ratified by our stockholders, our audit committee will consider the outcome of the vote in determining whether or not to retain EY for the fiscal year ending December 31, 2025. Even if the appointment is ratified by our stockholders, our audit committee, in its sole discretion, may appoint a different independent registered public accounting firm for the fiscal year ending December 31, 2025 at any time if our audit committee believes that such a change would be in the best interests of Loar and its stockholders.

A representative of EY is expected to be present at the Annual Meeting and will have an opportunity to make a statement if he or she so chooses, and is also expected to be available to respond to appropriate questions from stockholders.

Pre-Approval Policies and Procedures

We have adopted a policy under which our audit committee must pre-approve all audit and permissible non-audit services to be provided by our independent registered public accounting firm. Our audit committee may pre-approve our independent registered public accounting firm to perform a specific project, set of services, or transaction for our company or certain categories of services for our company. As part of its review, our audit committee also considers whether the categories of pre-approved services are consistent with the SEC’s rules on auditor independence. Our audit committee has pre-approved all services provided by our independent registered public accounting firm since the pre-approval policy was adopted prior to our IPO.

Fees Paid to the Independent Registered Public Accounting Firm

The following table presents the fees billed by EY and its affiliates for professional services rendered with respect to the fiscal years ended December 31, 2024 and 2023.

22

| Fiscal Year Ended December 31, | ||||

| 2024 | 2023 | |||

| (in thousands) | ||||

| Audit Fees(1) |

$1,827,600 | $2,342,900 | ||

| Audit-Related Fees(2) |

$324,000 | $526,500 | ||

| Tax Fees(3) |

$197,410 | $259,100 | ||

| All Other Fees |

$0 | $0 | ||

| Total Fees |

$2,349,010 | $3,128,500 | ||

(1) “Audit Fees” consist of fees for professional services provided in connection with the audit of our annual financial statements, review of our quarterly financial statements, and statutory and regulatory filings or engagements. For the fiscal year ended December 31, 2023, this category also included fees for services provided in connection with our IPO.

(2) “Audit-Related Fees” consist of fees for due diligence in connection with acquisitions.

(3) “Tax Fees” consist of fees for professional services provided for tax advice and tax planning.

Vote Required

The affirmative “FOR” vote of a majority of the votes properly cast at the Annual Meeting is required to ratify the appointment of EY. Abstentions and broker non-votes, if any, will have no effect on the outcome of this proposal.

OUR BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE RATIFICATION OF THE APPOINTMENT OF ERNST & YOUNG LLP AS OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR THE FISCAL YEAR ENDING DECEMBER 31, 2025.

23

Report of the Audit Committee

of the Board of Directors

The audit committee has reviewed and discussed the audited financial statements for the fiscal year ended December 31, 2024 with our management. The audit committee has also reviewed and discussed with Ernst & Young LLP, our independent registered public accounting firm, the matters required to be discussed by Auditing Standard No. 1301, Communications with Audit Committees, as adopted by the Public Company Accounting Oversight Board (the “PCAOB”). The audit committee has also received the written disclosures and the letter from Ernst & Young LLP required by the applicable requirements of the PCAOB regarding the independent accountants’ communications with the audit committee concerning independence and has discussed with Ernst & Young LLP its independence. Based on the foregoing, the audit committee has recommended to our board of directors that the audited financial statements be included in our Annual Report on Form 10-K for the fiscal year ended December 31, 2024 and be filed with the SEC.

Members of the Audit Committee:

| Taiwo K. Danmola (Chair) |

| M. Chad Crow |

| Margaret McGetrick |

The information contained in this report shall not be deemed to be “soliciting material,” “filed” with the SEC, subject to Regulations 14A or 14C of the Exchange Act, or subject to the liabilities of Section 18 of the Exchange Act. No portion of this report shall be deemed to be incorporated by reference into any filing of Loar under the Securities Act or the Exchange Act through any general statement incorporating by reference in its entirety this Proxy Statement in which this report appears, except to the extent that Loar specifically incorporates this report or a portion of it by reference.

24

PROPOSAL THREE

Amended and Restated Loar Holdings Inc.

2024 Equity Incentive Plan

In connection with the consummation of our initial public offering, our Board adopted, and our shareholders approved, our Loar Holdings Inc. 2024 Equity Incentive Plan (the “Existing Plan”), which provides that 9,000,000 shares are available for issuance with respect to awards granted under the Existing Plan. As of April 21, 2025, 8,946,429 shares of stock were available for issuance under the Existing Plan. The Compensation Committee, board of directors, and the Company’s management believe it is in the best interest of the Company and its shareholders to amend and restate the Existing Plan (as amended and restated, the “Plan”) primarily to remove the limitation contained in the Existing Plan as it relates to the group of employees eligible to receive grants under the Existing Plan during the five-year period commencing on our initial public offering. We are not asking our stockholders to increase the share reserve under the Existing Plan.

The modifications described above and the following description are summaries of the material features of the Plan but may not contain all the information you may wish to know. We encourage you to review the entire text of the Plan which is attached hereto as Appendix A. The Plan is not required to be qualified under Section 401 of the Internal Revenue Code of 1986 (“the Code”) nor is it subject to the provisions of the Employee Retirement Income Security Act of 1974. The Compensation Committee has approved the Plan.

The Plan is our only current long-term incentive plan under which equity awards may be granted to our employees, non-employee directors and other service providers. In December 2024, we also made certain stock option grants under the inducement grant exemption under New York Stock Exchange Rules, with respect to an aggregate of 68,000 shares of our common stock.

Summary of the Amended and Restated Equity Incentive Plan

Share Reserve

As of April 21, 2025, an aggregate of 8,946,429 shares of our common stock are available for issuance under the Plan, which represents 9.56% of our shares outstanding as of this same date. Shares issued under the Plan may be authorized but unissued shares or treasury shares. If an award under the Plan expires, terminates, or is forfeited, settled in cash, or canceled without having been fully exercised, any unused shares subject to the award will be available for new grants under the Plan. If shares issuable upon exercise, vesting, or settlement of an award are surrendered or tendered to the Company in payment of the purchase or exercise price of an award or any taxes required to be withheld in respect of an award, in each case, in accordance with the terms of the Plan, such surrendered or tendered shares will be added back to the share reserve.

Awards granted under the Plan in substitution for any options or other stock or stock-based awards granted by an entity before the entity’s merger or consolidation with us or our acquisition of the entity’s property or stock will not reduce the shares available for grant under the Plan, but may count against the maximum number of shares that may be issued upon the exercise of incentive stock options. As of April 21, 2025, the closing price of a share of our common stock as reported on the New York Stock Exchange was $81.69 per share.

Administration

The Plan will be administered by our Compensation Committee. The Compensation Committee has the authority to construe and interpret the Plan, grant awards and make all other determinations necessary or advisable for the administration of the plan. Awards under the Plan may be made subject to “performance conditions” and other terms.

25

Eligibility

Our employees, consultants, advisors and directors, and employees, consultants, advisors and directors of our affiliates, will be eligible to receive awards under the Plan. The Existing Plan provides that no awards may be made under the Existing Plan within five years of our initial public offering other than awards in connection with our initial public offering, awards to newly hired employees and awards to eligible non-employee directors. If Proposal Three is adopted, an employee will be eligible to receive a grant regardless of the date of hire, and employees will be eligible to receive supplemental grants at the discretion of the Compensation Committee (for example, if an employee is promoted and non-employee directors will continue to be eligible to receive awards, without regard to the five-year period contained in the Existing Plan). The Compensation Committee will determine who will receive awards, and the terms and conditions associated with such award subject to the terms and conditions of the Plan. As of April 21, 2025, we estimate that approximately 1,500 employees and 3 non-employee directors would be eligible to participate in the plan (as of such date, we estimate that no consultants or advisors would be eligible to participate in the plan).

Term

The Plan will terminate on April 16, 2034 unless it is terminated earlier by our Board.

Stock Options

Options granted under the Plan may be exercisable at such times and subject to such terms and conditions of the Plan and as the Compensation Committee determines. The maximum term of options granted under the Plan is the earlier of (i) 10 years from the grant date, (ii) 90 days after the date of termination of employment other than upon death, disability or cause, (iii) one year after the date of separation from service for death or disability, or (iv) upon termination for cause (except as otherwise determined by the Compensation Committee).

Stock Bonuses

Bonuses payable in fully vested shares of our common stock consist of matching share grants described under “Management—Director Compensation.”

Additional Provisions; Change in Control

Awards granted under the 2024 Plan may not be transferred in any manner other than by will or by the laws of descent and distribution, and all such rights will be exercisable, during the participant’s lifetime, only by the participant, except for certain non-statutory stock options that may be transferred to certain family members as the Compensation Committee determines. In the event of a change in control (as defined in the Plan), all outstanding stock options will become immediately exercisable with respect to all of the shares subject to such stock options. In the event of any change to our outstanding common stock or capital structure, such as a stock split, reverse stock split, recapitalization, reorganization, merger, consolidation, combination, division, exchange, spin off, stock dividend, or extraordinary cash or non-cash dividend or other relevant change in capitalization or any extraordinary cash or non-cash dividend, all awards will be equitably adjusted or substituted (which may include cash payments) to the extent necessary to preserve the economic intention of such awards. A committee or subcommittee appointed by the Board may establish a program under which dividend equivalent rights may be granted in conjunction with other awards, and it is intended that any such dividend equivalent rights would be either exempt from, or in compliance with, Section 409A.

Amendment and Termination

The Board may amend or terminate the Plan at any time, subject to stockholder approval to the extent required by applicable law. The Compensation Committee may amend any award, provided, however that no amendment will be effective unless it is approved by stockholders to the extent required by applicable law. No amendment or termination may substantially impair rights under any award without the consent of an affected participant.

Certain Federal Income Tax Consequences

The following is a summary of certain U.S. federal income tax consequences associated with stock options granted under the Plan. The summary does not purport to cover federal employment tax or other U.S. federal tax consequences that may be associated with the Plan, nor does it cover state, local or non-U.S. taxes, except as may be specifically noted.

26

Stock Options (other than ISOs). In general, a participant has no taxable income upon the grant of a stock option that is not intended to be an ISO (an “NSO”) but realizes income in connection with the exercise of the NSO in an amount equal to the excess (at the time of exercise) of the fair market value of the shares acquired upon exercise over the exercise price. A corresponding deduction is generally available to the Company. Upon a subsequent sale or exchange of the shares, any recognized gain or loss is treated as a capital gain or loss for which the company is not entitled to a deduction.

ISOs. In general, a participant realizes no taxable income upon the grant or exercise of an ISO. However, the exercise of an ISO may result in an alternative minimum tax liability to the participant. Generally, a disposition of shares acquired pursuant to an ISO within two years from the date of grant or within one year after exercise produces ordinary income to the participant (and generally a deduction to the company) equal to the value of the shares at the time of exercise less the exercise price. Any additional gain recognized in the disposition is treated as a capital gain for which the company is not entitled to a deduction. If the participant does not dispose of the shares until after the expiration of these one- and two-year holding periods, any gain or loss recognized upon a subsequent sale of shares acquired pursuant to an ISO is treated as a long-term capital gain or loss for which the company is not entitled to a deduction.

New Plan Benefits

The following table sets forth the awards that were granted to our named executive officers, the other executive officers, as a group, our non-employee directors, as a group, and all other employees, as a group, under the Existing Plan during the 2024 fiscal year. Our executive officers and employees only received stock options during the 2024 fiscal year and our non-employee directors received stock bonuses.

| Name and Position | Number of Stock Options |

Number of Stock Bonus Shares |

||

| Dirkson Charles, President, Chief Executive Officer and Executive Co-Chairman |

710,000 | None | ||

| Brett Milgrim, Executive Co-Chairman |

710,000 | None | ||

| Glenn D’Alessandro, Treasurer and Chief Financial Officer |

385,000 | None | ||

| Other Executive Officers (as a Group) |

385,000 | None | ||

| Non-Employee Directors (as a Group) |

None | 53,571 | ||

| All Other Employees as a Group |

3,003,000 | None | ||

The foregoing is only a summary of the Amended and Restated Loar Holdings Inc. Equity Incentive Plan and is qualified in its entirety by reference to its full text, a copy of which is attached hereto as Appendix A.

Vote Required

The affirmative “FOR” vote of a majority of the votes properly cast at the Annual Meeting is required to approve the Company’s Amended and Restated Loar Holdings Inc. 2024 Equity Incentive Plan. Abstentions and broker non-votes, if any, will have no effect on the outcome of this proposal.

OUR BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE APPROVAL OF THE COMPANY’S AMENDED AND RESTATED LOAR HOLDINGS INC. 2024 INCENTIVE PLAN.

27

Executive Officers

The following table sets forth, for our executive officers, their ages and position held with us as of April 21, 2025:

| Name | Age | Title | ||

| Dirkson Charles |

61 | President, Chief Executive Officer, Executive Co-Chairman and Director | ||

| Brett Milgrim |

56 | Executive Co-Chairman and Director | ||

| Glenn D’Alessandro |

61 | Treasurer and Chief Financial Officer | ||

| Michael Manella |

68 | Vice President, General Counsel and Secretary | ||

Biographical information for Mr. Charles and Mr. Milgrim is included above with the director biographies in the section titled “Information Regarding Director Nominees and Current Directors.”